Money Makeover

Hello and welcome. We know why you’re here. As hectic as life is, you’re refusing to go another day with chaotic, frustrating finances. If you’re ready to do the work, we promise you’ll see and feel your life transformation as you navigate through these exercises.

Feel free to peruse the topics a bit, but don’t be intimidated by all that lies ahead. Your transformation isn’t meant to happen overnight but rather, like the path to any type of fitness, is the result of simple, intentional efforts that evolve into regular habits.

We’ve designed each task to take less than an hour, but the ebb and flow of your money may mean that your end goal isn’t achieved for months or even years. With a Money Fit Makeover plan in action, you can be assured that with every step, your finish line draws nearer, and with it, the life you’ve hoped for.

Know Your Strengths and Weaknesses: Creating a Financial Overview

We know how it feels to open bank accounts when you come of age, then you add more accounts as you finance cars or take advantage of a new credit card. Then comes the student loan accounts, and lastly you have retirement plans. Soon, you’ve lost track of how much money you have and where not to mention how much debt you owe and to who. The stability you’ll feel when you reacquaint yourself with your whole picture will amaze you. It may seem overly simplified, but you need to trust the process. Here’s how to get started with varying levels of intensity:

For Beginners:

Before you start tracking down information, first decide where you’ll store it. You may consider using a notebook, some type of spreadsheet, or a board that you hang on a wall in a private place in your home. We suggest somewhere that allows you to see everything all at once.

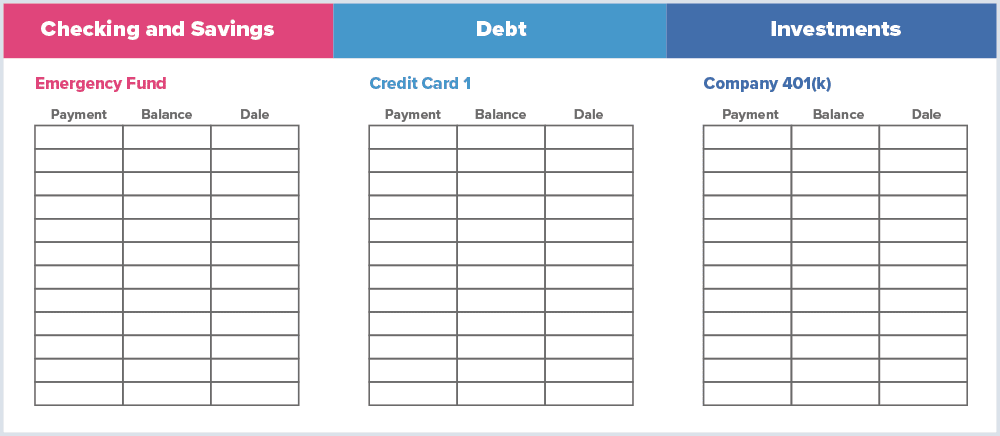

Next, create a three-column, twelve-row chart for every account you can think of, whether old or new, closed or open. If there’s a balance, include it in your overview, even if the balance is negative.

Now, write the account name above each chart. Then, label the top of each column with the words, “Payment,” “Balance,” and “Date.”

Consider placing your charts within three distinct areas: checking and savings, debts, and investments. For a visual idea, refer to the summarized image below:

Your checking and savings section should be filled with all assets or positive accounts – money you have access to, not money owed.

The second section, debts, should identify all debts including loans, credit card balances, medical payment plans, collections, store cards, etc.

Your last section will consist of money that is hands-off such as 401(k)s, 403(b)s, traditional IRAs, Roth IRAs, stock portfolios, or pension plans.

Pro Tip: Use nicknames as identification instead of account numbers. You wouldn’t want all your sensitive information falling into the wrong hands.

From here, you’ll want to obtain and fill in up-to-date balances and information in the first line of each chart for each account. Voilà! Your overview is finished! You should now be able to identify what areas you might want to improve.

Kick it Up a Notch:

For a more intermediate approach, you can track your progress over the next year. Each month, ideally on the same day, update your account balances in the remaining lines. Over time you can watch your helpful accounts grow and hurtful accounts shrink as you carefully guide your money to your goals.

Optimize Performance: Give Your Income Direction

Now that you have a financial overview, you are likely considering what kind of changes you’d like to make if you could. Certainly, you are hoping to beef up certain account balances while eliminating certain others entirely. Obviously, the common factor in accomplishing these feats is extra money! So, the question is, where can you find some?

Down the line you might consider picking up more hours or responsibilities at work, getting a temporary part-time job, or switching careers to something more lucrative. However, for this exercise, we are going to make the most of what you already have.

Part 1

We’ll start by weighing your income verse expenses. First, write down your monthly household income listing the source and amount. This might include a partner or spouse. It may be from employment, unemployment, social security, retirement-related income, dividends, real estate, or any other source that fuels your bank account during the month.

Second, write down all your expenses, listing their description and amount. It may be easiest to organize them by categories like those that follow:

- Housing and Utilities

- Includes rent or mortgage, gas, electricity, water, trash, sewer, etc.

- Food

- Includes groceries and supplies, treats, bag lunches, etc.

- Transportation

- Includes bus fares, car payments, gas, parking or toll road passes, maintenance, etc.

- Insurance

- Includes home, car, health, life, etc.

- Family

- Includes clothing, extracurricular activities, haircuts, beauty services, etc.

- Entertainment

- Includes subscriptions for movie and TV streaming, cable or satellite, cinema tickets, dining out, outings to venues, shopping, etc.

- Debt Repayment

- Includes credit cards, payday or personal loans, student loans, medical or collections repayment plans, etc.

- Miscellaneous

- Include school supplies and tuition, pet costs, gift-giving, etc.

Once fully listed, add up all your expenses. Subtract this amount from the sum of your income. This will reveal what money you have to work with. If you find your balance in the negative, consider the areas where you may be able to cut back.

Either way, these results should give you an idea of how much money you can squeeze out of your budget to re-purpose for repaying debts, building savings and security, or getting a little more lasting enjoyment out of life.

Feel free to take a break before moving on to part 2 or come back to it the next time you can.

Part 2

The next step is essential in your Money Fit Makeover. It’s great that you now know how much money is left over, but in the follow-up exercise, you’ll find out when this money is available to use. This is also referred to as cash flow.

The process of tracking cash flow might remind you of the days of filling out a checkbook account register. If this isn’t ringing a bell, dig up your checkbook and skim through the last few pages. This section of the booklet was once used to calculate your new balance when you either made a deposit or a withdrawal or purchase.

You’ll be doing the same kind of adding and subtracting in this exercise, only you’ll be referring to your main (or “rotating”) account’s transaction history.

The easiest way to start determining your cash flow is to figure out what amount on average you start with on the first day of each month. This will vary for everyone depending on where paydays and bills fall. There isn’t a right answer, so long as the number isn’t negative.

From here, you’ll want to list every expense up until your next regularly occurring deposit, such as a paycheck. Subtract these expenses from your initial balance. What’s the difference? Be sure to note it in its own column. What can the purposeful use of that money accomplish for you?

Continue on with your calculation adding your inflow of income to your previous balance and then subtract the next set of bills that occur before you are paid again or otherwise receive income. Complete this process until you reach the end of the month. Looking back, you should be able to gather from your notes, the best times to siphon off your excess money for more intentional use. Nail down what these amounts are and save the number for activities later on in your Money Fit Makeover.

Play by a Budget: Sideline Excessive Spending

It’s great to open up financial conversations with friends and family, but it’s never a good idea to assume that their lifestyle or budget is right for you. Your financial situation is unique to your income, expenses, and values.

To begin this exercise, print out any bank statements that record your spending for the month. Go through it line by line and assign each expense a category. For ideas on categories, refer back to the previous section under Income.

Once all spending has been accounted for, find the total amount spent on each category.

Do any of your results surprise you? Last-minute, impulse, or unrestricted spending can often add up to more than you would think. Take what you’ve learned and create a plan (or budget) for next month.

Some areas you might consider monitoring closer include coffee runs, groceries, shopping, alcohol, dining out, tobacco usage, vaping, etc. Curbing hard-set habits takes time, so it’s perfectly reasonable to only cut 5%-10% the first time around. Continue to do so until you feel your budget category is as lean as it needs to be.

To finish, jot down all your monthly expenses by category and note what you aim to spend on them in the coming month. Review this budget every few days in your first month so you’ll know if you’re staying on target. As you make a conscious effort to alter your spending, it will eventually become second nature and you’ll soon feel confident in the way you manage your money.

Shed that Debt

No one needs to tell you how stressful debt can be. It seems we’ve all been there. One of the best things you can do for not only your financial wellness but also your physical and mental health is to pledge to get and stay out of debt for good. If your credit-related bills have begun to weigh on you, take this moment to research the following debt management options and decide which solution is best for you:

Pay On Your Own

You can find detailed instructions about how to use the Debt Avalanche, Debt Landslide, Debt Snowball, Debt Cascade, or a combination of these methods to whip your debt into shape in the Money Fit Academy.

Debt Consolidation Loan or Balance Transfer Credit Card

These two tools work similarly. Essentially, you’ll pay off your old debt and consolidate many credit or loan accounts into one new account. The main reason anyone would do this is to simplify their repayment process while at least attempting to secure better repayment terms, such as a lower interest rate. If you chose this method, you would need to be sure you can afford the payment and abide by the set timeline. Additionally, you want to make sure you don’t run the balances of your paid-off accounts back up after consolidating them. Pay them off and either cut them up or close them down.

Debt Management Program

Sometimes associated with credit counseling, debt management gives guidance and structure to help clients repay their debt in a more comfortable way. Look for a program that is low-cost and delivers multiple benefits. You may want to ask about lower interests, waived late and over-limit fees, mediation between the client and creditors, and a single, consolidated monthly payment. These concessions often give households the advantage they need to begin surmounting their debt.

Bankruptcy

Before starting any legal process, consult a certified credit counselor to see if your debt can be remedied with other solutions. Bankruptcy is a drain on emotions and your credit rating. If there is any chance you can reconcile your situation by negotiating with creditors and practicing a bit more self-discipline, the effort will be worth the outcome.

If bankruptcy does become your final option, you will need to meet with an approved credit counseling agency for a budget briefing anyway. This is why we recommend meeting a counselor from Money Fit first.

As you wade through debt repayment, remember that with a plan in place, this uncomfortable phase will come to end. You can look forward to re-purposing this part of your budget for bigger and better things in the future.

Keep Your Eye on the Prize: Set Meaningful Goals

While remarkably beneficial, the exercises leading up to this point will never be described as fun. Cheers to sticking it out anyway because this is where your Money Fit Makeover gets exciting!

Your more sensible goals, like paying off debt, may have brought you here, but we believe you deserve to achieve your more exciting goals as well. When it comes down to it, good financial health will mean very little if it’s not providing real-life fulfillment. So, this is the part where you plan to accomplish the things you care about.

As is most often the case, let’s start with a list. Freely write what comes to mind when you envision your dream life. Include necessary things like being debt-free, having an emergency fund, securing your retirement, but also giving yourself permission to acknowledge what you desire most. Gain some inspiration from the list below:

- Fully Funding a Hobby

- Moving

- Buying a Second Property

- Shifting Careers

- Ability to Be More Charitable

- Build Generational Wealth

- Owning a home

- Taking a Yearly Vacation

- Funding Children’s College

- Buying a Newer Car

- Live on a Single Income

- Seeing a Bucket List Sight

- Related Articles

Essential to this exercise, you’ll need to prioritize these goals from most to least important, taking into consideration the timeline in which they can be achieved.

The next part will take some careful thought. You’ll want to take the amount of excess money that you calculated in the earlier exercise on income and expenses and divide it between your top goals.

If you are paying on a debt, the amount you assign may be determined by the minimum amount due every month. If you are paying it back on your own, you will also want to pay more than you are required in order to get ahead of accumulating interest.

Whatever is leftover can be divided as desired. As an example, one might be working toward five separate goals. For example, they might include paying off student loans, paying off a personal loan, building an emergency fund, saving for a vacation, and contributing to retirement. This individual has $750 in excess each month. According to their priorities, this is how they might divide the amount between their goals:

- Student loans (minimum plus extra): $150

- Retirement (3% of income): $150

- Emergency Fund: $100

- Vacation Fund: $50

- Personal Loan (minimum plus extra): $300

Note: It’s recommended to contribute between 10% and 15% toward your retirement monthly. However, if that seems impossible at this point in time, work your way up to that amount little by little.

Now that you’ve assigned your extra money a purpose, you can take a breather. When ready, move on to the next step in the Money Fit Makeover.

Pump Up Savings: Automate with Purpose

When you set up an automated transfer to your savings, you are making a commitment. Taking this action is an effective way to work toward the goals you identified in Step 5.

To accomplish what you’ve set out to do, you may want to set up one or more new, separate savings accounts. This will make your savings process easier and more organized. You can research savings accounts at your current bank, or a local credit union, or browse online options. The objective should be to garner the highest Annual Percentage Yield (interest your money earns for you) while avoiding any monthly fees or cumbersome conditions.

You’ll want to make sure that whichever institution you choose, your accounts are secure and insured. You may also want to experiment with just a small amount of money to start as you get to know the service and its features. Savings is a part of your long-term plan to find a bank that is satisfactory in the most important ways.

Once this is settled, arrange a monthly automated transfer of your decided amount. Then sit back and watch your goals work themselves out. You will want to check back every month to update your financial overview from exercise one and ensure that nothing needs your attention. Each time you increase your income or finish paying off debt, consider funneling this newfound money toward one of your goals. Once you’ve taken this initiative, your accomplishments will start to snowball and you will begin to enjoy the fruits of your labor.

Invest in Your Health: Plan for Your Future

The last step in your Money Fit Makeover is fortifying your finances against misfortune and securing your future. Part of being or becoming a self-reliant adult is thinking not just about today, but tomorrow also. You’ll find that when you’ve protected yourself against what could happen tomorrow, you’ll spend far less energy worrying.

Part 1

If you haven’t already set up a short- and long-term emergency fund now is the time to nail those down. The former is for unexpected expenses such as a car repair, and the latter is for events such as job loss. Even if all you can set aside in these accounts is $10 a month, you will still be less burdened when an emergency occurs than if you save nothing at all.

Having a nice buffer saved increases your freedom of choice reduces daily expense-related stress and makes crises manageable. Panic will be a thing of the past. Take time now to consider how much you can save monthly and get a plan into motion. Let these questions guide your exercise:

- What is my goal total for my emergency funds?

- How much can I afford to save monthly for emergencies?

- How quickly do I need to be able to access this money?

- Where should I keep my emergency fund?

- Should I set up an automated transfer to savings monthly?

Part 2

For one of your final exercises, research insurance opportunities. This might include health, dental, auto, business, and life insurance. You may want to consult your state’s Department of Health and Welfare, or your company’s HR representative, or ask your friends and family for recommendations.

Insurance may seem like an unnecessary luxury at times but can help save money if you find the best plans for your household. The key is to strike a balance between what’s affordable and what will most reduce your risk of taking on expenses you can’t handle upfront. Think of it as a trade-off: paying a little all along the way so that when the unexpected happens (and it WILL happen), your insurance can provide the funds to cover costs.

If you decide to add an insurance policy or two, be sure to adjust your financial overview with the monthly payment and reduce the total amount you have to distribute in your savings plan.

Take some pride at this moment! You may not realize it just yet, but your new life is beginning now. We may have provided some guidance, but it was your effort that accomplished this feat. You did it and the power lies within you to continue your path toward a stable and fulfilling life. The best reward will be watching a better future unfold.

Be vigilant in the areas discussed, revisit your priorities from time to time, and when feeling a little lost, feel free to reach out for help. We’re happy to offer support all throughout your transformation.

Share and Comment

Please share this post on your social media accounts to help get this information out to others who so desperately need it. For Twitter and Facebook, please click on the button below.

We would also love to hear your story about how these steps have changed your life. Enter your comments in the discussion field below or reply to current comments.

If you have a compelling story related to your own Money Fit Makeover and might be interested in sharing it on The Money Fit Show podcast, please reach out to the host on our podcast.