Unpacking Personal Finance Lessons from The Office: A Humorous Guide to Money Matters

The Office, an American television series that aired from 2005 to 2013, has had an undeniable cultural impact. Originally based on a UK series of the same name, the US version quickly took on a life of its own, becoming one of the most beloved sitcoms of its time. Known for its unique mockumentary style, memorable characters, and humorous depiction of everyday office life, The Office has maintained an enduring relevance and popularity even years after its original airing.

While The Office is primarily a comedy show, it’s also a surprisingly rich source of lessons about personal finance. The series often uses financial situations as plot devices, and many of its characters have storylines that relate to money management, debt, investment, and financial planning. This offers us the opportunity to dissect these moments and extract valuable financial wisdom, albeit sometimes from their mistakes rather than their successes.

This article aims to delve into some of the most significant personal finance lessons learned from The Office. It’s an exploration of how a popular television show can inadvertently provide financial education and insight. By using familiar and beloved characters and situations from the show, we hope to make these personal finance lessons engaging, accessible, and fun for readers. Whether you’re a die-hard fan of The Office or a casual viewer, we believe there’s something valuable to be learned from the financial misadventures of Michael Scott and his team.

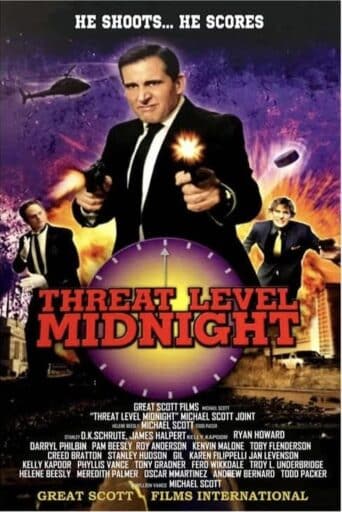

Lesson 1: Understand the Value of a Dollar – Michael Scott’s “Threat Level Midnight”

Michael Scott, the eccentric and often misguided manager of Dunder Mifflin Scranton, spent 11 years and an untold amount of his personal funds creating his amateur action film, “Threat Level Midnight.” While his passion and dedication are commendable, his lack of financial foresight is less so. This project illustrates how easy it is to let passion overrule practicality when it comes to money.

Passion projects can be a great way to enrich your life and even potentially make extra income. However, as shown by Michael, they can also be a financial pitfall if not carefully managed. Money spent on such projects is money that could be saved, invested, or used for necessary expenses. Before embarking on a passion project, it’s essential to consider the cost and weigh it against your other financial obligations and goals.

If you’re considering a passion project, here are a few tips to keep your finances in check:

- Set a Budget: Before you start, decide how much you can afford to invest in your project without negatively impacting your essential expenses and financial goals.

- Track Your Expenses: Keep a record of all the money you spend on your project. This will help you understand where your money is going and if you’re staying within your budget.

- Time is Money: Don’t forget to consider the value of your time. Time spent on a project is time that could be spent earning money, so make sure your project is worth the time investment.

- Plan for the Unexpected: Projects often end up costing more than expected. Set aside a portion of your budget for unforeseen expenses to avoid going over budget.

By understanding the value of a dollar and managing your money wisely, you can pursue your passions without jeopardizing your financial health.

Lesson 2: Don’t Put All Your Eggs in One Basket – Diversification and Michael’s “Serenity by Jan”

In season four, Michael Scott becomes financially entangled with his former boss and girlfriend, Jan Levinson, and her candle-making business, “Serenity by Jan.” Despite the clear signs of instability (both in the business and in Jan herself), Michael pours a significant amount of his money into this venture, illustrating a classic case of poor investment diversification.

Diversification, or spreading your investments across various ventures, is a key principle of sound investing. By placing all his money into “Serenity by Jan,” Michael is risking too much on a single, shaky venture. If the business fails, he stands to lose everything. This storyline underscores the importance of not putting all your eggs in one basket.

Tips on how to diversify one’s income and investments:

- Spread Your Investments: Don’t invest all your money in one place. Spread it across different types of investments, such as stocks, bonds, real estate, and mutual funds.

- Consider Passive Income: Look for opportunities to create passive income, such as rental income or dividends from investments.

- Regularly Review and Adjust: Market conditions change, and so should your investment strategy. Regularly review your investments and make adjustments as needed to maintain a balanced portfolio.

- Seek Professional Advice: If you’re unsure about how to diversify your investments, consider speaking with a financial advisor.

By diversifying your income and investments, you can reduce the risk of financial loss and increase the potential for financial growth. As the old saying goes, don’t put all your eggs in one basket – or in Michael’s case, one scented candle business.

Lesson 3: Always Have a Rainy Day Fund – The Office’s Multiple Closures and Buyouts

Throughout the course of The Office, Dunder Mifflin faces a series of financial crises, including branch closures, company buyouts, and threats of bankruptcy. The employees, particularly those at the Scranton branch, are often left in a state of uncertainty about their job security.

These plot lines serve as a stark reminder of the unpredictability of life and the importance of having a financial safety net. An emergency fund – a stash of money set aside to cover the financial surprises life throws your way – is a key component of sound financial planning. Without one, sudden job loss or unexpected expenses can lead to debt, stress, and financial instability.

Tips for creating and maintaining an emergency fund:

- Start Small: If you’re just starting out, aim to save a small emergency fund first, perhaps enough to cover a month’s worth of expenses. You can then build it up over time.

- Set a Goal: Financial experts generally recommend having enough in your emergency fund to cover 3-6 months’ worth of living expenses.

- Make it Automatic: Set up automatic transfers to your emergency fund each month to ensure you’re consistently saving.

- Keep it Accessible: Your emergency fund should be easily accessible, not tied up in investments. Consider keeping it in a high-yield savings account.

Life is full of surprises, some of which can have significant financial implications. As the employees of Dunder Mifflin learned, it’s always a good idea to have a rainy day fund.

Lesson 4: Understand Your Debt – Michael Scott Declares Bankruptcy

This episode humorously highlights some common misconceptions about debt and bankruptcy. Bankruptcy is a legal process that can help individuals or businesses eliminate or repay some or all of their debt, but it’s not a magic fix. It’s a last resort that can have serious long-term effects on your credit and financial future.

Understanding your debt is crucial to managing your finances effectively. This includes knowing how much you owe, what your interest rates are, and what your repayment schedule looks like. If debt becomes overwhelming, services like debt consolidation can be a valuable tool to simplify payments and possibly lower interest rates.

Debt consolidation involves taking out a new loan to pay off multiple debts. This means you only have one monthly payment, which can make managing your debts easier. Services like Money Fit offer debt consolidation programs that can help you better manage your debt, reduce your interest rates, and set you on a path toward financial freedom.

Tips on how to avoid getting into overwhelming debt and what to do if you find yourself in such a situation:

- Budget and Track Spending: Know where your money is going and avoid spending beyond your means.

- Prioritize Paying Off High-Interest Debt: High-interest debts cost you more over time. Aim to pay these off first.

- Seek Help When Needed: If you’re feeling overwhelmed by debt, don’t hesitate to reach out to professionals. Organizations like Money Fit can provide you with the tools and guidance you need to manage and overcome debt.

In conclusion, while declaring bankruptcy isn’t as simple as Michael Scott thought, understanding and managing your debt is a crucial part of financial health. By staying informed and seeking help when needed, you can prevent debt from becoming a crippling problem.

Lesson 5: The Risks and Rewards of Entrepreneurship – Michael Scott Paper Company

In season five, Michael Scott resigns from Dunder Mifflin to start his own paper company, aptly named the Michael Scott Paper Company. Despite initial struggles and a shoestring budget, Michael and his small team manage to steal some key clients from Dunder Mifflin, eventually forcing the company to buy them out.

The Michael Scott Paper Company storyline provides a dramatic example of the risks and rewards of entrepreneurship. Starting a business can be a high-risk, high-reward endeavor. While Michael faces financial instability and the potential for failure, he also experiences the satisfaction of building something of his own and ultimately reaps a significant reward.

Practical advice for potential entrepreneurs:

- Conduct Market Research: Understand the market and your potential competition before you start your business.

- Create a Business Plan: A detailed plan can guide your startup process and help you stay on track.

- Plan Your Finances: Start with a clear understanding of your startup costs, operating costs, and personal cost of living. This can help ensure you have the financial resources you need to give your business a fair shot.

- Consider the Legal Implications: Depending on your business, you may need to consider licenses, permits, insurance, and legal structures (like LLCs).

- Be Prepared for Challenges: Entrepreneurship is a journey filled with ups and downs. Resilience and flexibility are key to overcoming obstacles.

The tale of the Michael Scott Paper Company offers a comedic but insightful look at the trials and tribulations of entrepreneurship. While starting a business can be risky, with careful planning, tenacity, and a bit of luck, it can also offer substantial rewards.

Lesson 6: Know Your Worth – Jim’s Job Negotiations

Jim Halpert’s career trajectory offers several opportunities to discuss the importance of knowing one’s worth in the workplace. From his initial role as a salesman to his eventual promotion to co-manager of the Scranton branch, Jim has several instances where he needs to negotiate his salary and job responsibilities.

Salary negotiation is a critical skill in maximizing your income and, by extension, your potential for savings and investments. Underestimating your value can lead to lower earnings and potential financial stress. Jim’s career progression in The Office can serve as an important lesson in self-advocacy and negotiation.

Practical tips on how to negotiate salary and understand your value:

- Research: Understand the industry standard for your role and experience level. This will give you a benchmark for your negotiations.

- Show Your Value: Be ready to demonstrate how you’ve contributed to the company. Specific examples of how you’ve added value can strengthen your negotiation position.

- Practice: Negotiations can be stressful. Practicing your negotiation script beforehand can help you feel more confident.

- Be Prepared to Walk Away: If an offer doesn’t meet your needs or reflect your worth, it’s okay to walk away.

Understanding your worth in the workplace is an essential part of your overall financial health. By effectively negotiating your salary and advocating for yourself, you can ensure your earnings reflect your value, ultimately benefiting your personal finances.

Bringing it All Together: Financial Wisdom from The Office and Beyond

Despite being a comedic television show, The Office provides viewers with several valuable lessons on personal finance. Through the various financial misadventures of its beloved characters, we’ve explored the importance of understanding the value of a dollar, the necessity of diversification, the need for a rainy day fund, the importance of understanding and managing debt, the risks and rewards of entrepreneurship, and the significance of knowing your worth in the workplace.

These lessons underscore the importance of financial literacy in navigating the complexities of personal finance. Whether it’s managing debt, planning for financial emergencies, starting a business, or negotiating a salary, having a strong grasp of financial principles can significantly impact your financial health and stability.

We encourage you to take these lessons to heart and apply them in your own financial journey. While your personal finance journey may not be as dramatic or humorous as the financial escapades in The Office, the principles remain the same.

Remember, personal finance is just that – personal. What works for one person may not work for another. Always consider your individual circumstances, goals, and values when making financial decisions. And don’t forget – there’s no shame in seeking help or advice. Whether it’s from a friend, a financial advisor, or a blog post about a beloved television series, there’s financial wisdom to be found in many places.

Disclaimer: The Office is a trademarked product of NBC Universal and is currently streaming on the Peacock network. All related names, characters, and images are copyright of their respective owners. The use of any copyrighted material in this blog post is used under the guidelines of “fair use” for the purpose of analysis, critique, and education. No infringement of copyright is intended.