How Are Lottery Winnings Taxed?

Are you dreaming of winning the lottery and hitting the jackpot? We all know that rush of excitement imagining what we’d do with a sudden windfall of cash—whether it’s jetting off on endless vacations, upgrading your life with a dream house or car, or even quitting your job for good. It’s fun to daydream, right? But, before you dive into those lavish plans, there’s a real-world consideration that might take the shine off that lottery ticket: taxes. Yep, Uncle Sam wants a cut of your jackpot, and the IRS doesn’t play games when it comes to lottery winnings.

Before you start planning your extravagant shopping spree, let’s take a closer look at what you can expect in terms of taxes if you hit it big. Don’t worry—we’ll make it as painless as possible. Whether you’re a casual lotto player or just curious about the tax side of a billion-dollar windfall, this breakdown will help you understand the reality behind the fantasy.

Key Takeaways

- Lottery winnings are taxed as income, with a federal rate up to 37%.

- Some states charge 0% on lottery winnings; others charge up to 8%.

- You can choose a lump sum or annuity to manage your tax liability.

- Plan ahead with a tax pro to avoid losing your windfall.

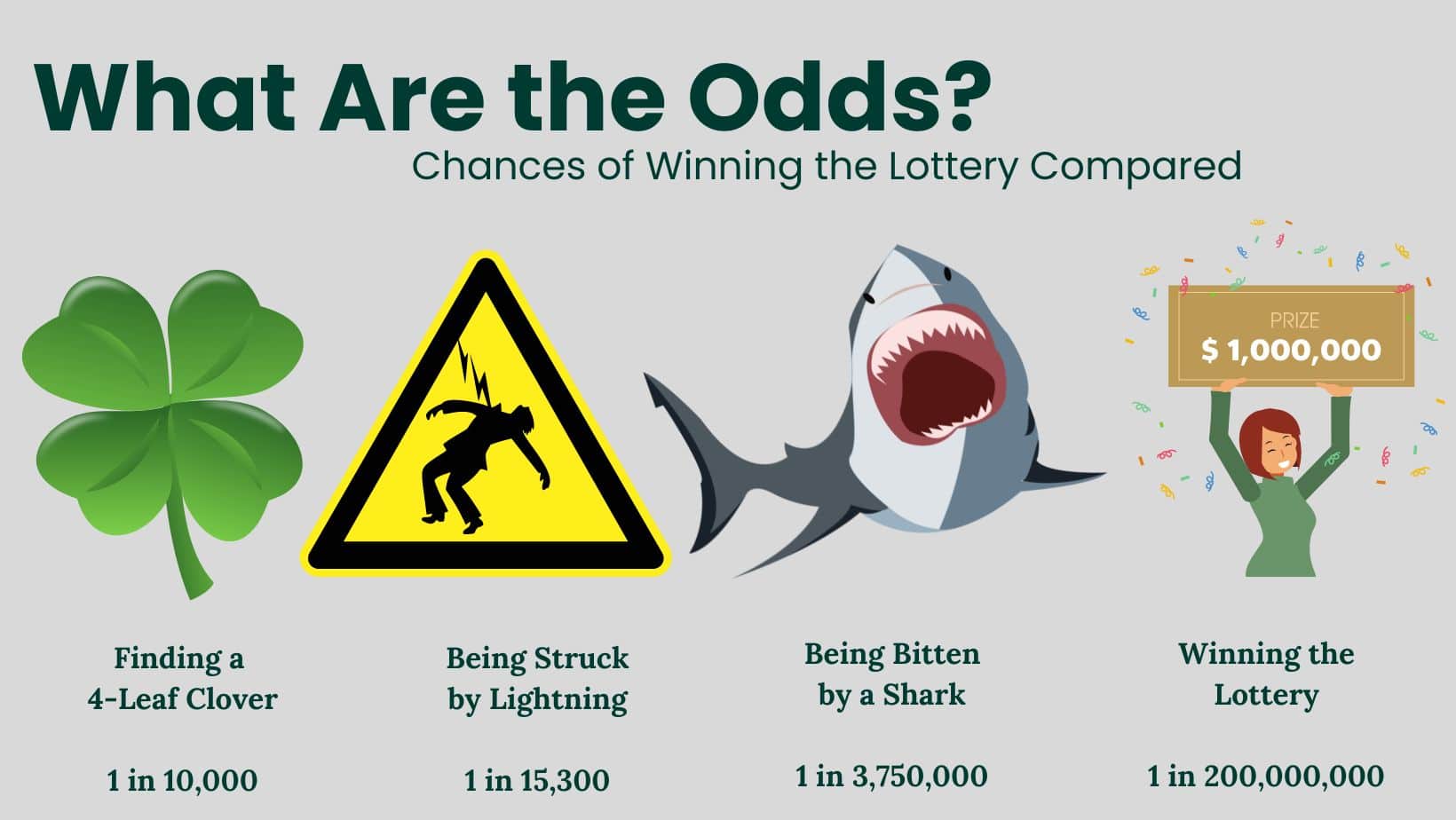

Chances of Winning a Lottery

Let’s be real—winning the lottery is the dream of many, but statistically speaking, it’s next to impossible. The odds of winning a major jackpot are estimated to be around 1 in 200 million. To put that into perspective, you have a better chance of being struck by lightning than winning that massive prize! Still, someone has to win, right? Just keep in mind that the odds are not in your favor, so keep those dreams in check while planning your next ticket purchase.

Factors That Affect Your Prize’s Taxes

Now, let’s get into the nitty-gritty. If you’re lucky enough to snag that winning ticket, taxes are going to come into play immediately. Several factors will affect how much of your prize is shaved off for taxes:

- Total Winnings: The bigger your prize, the higher your tax bill. Large jackpots push you into higher tax brackets.

- State of Purchase: State tax laws on lottery winnings vary significantly. Some states don’t tax winnings at all, while others can take up to 8%.

- Personal Income: Your winnings are added to your yearly taxable income, which could push you into a higher bracket.

- Lump Sum vs. Annuity: How you choose to receive your winnings will impact your tax burden. A lump sum can mean paying more upfront, while an annuity spreads out payments (and taxes) over time.

Important: Always consult a tax professional to help you navigate the tax implications of a big win. Tax laws are complex, and getting expert advice can save you from costly mistakes.

How Do Taxes Work With Lottery Winnings?

In the United States, lottery winnings are treated as taxable income by the federal government, and depending on where you live, you could owe state taxes too. The federal government will automatically withhold 24% of your winnings, but you could owe more depending on your tax bracket. Some states also take a bite out of your prize, while others don’t touch lottery earnings.

Let’s use some recent jackpots as an example. If you won a billion-dollar-plus prize, the taxman is coming for you! Here’s how the numbers break down:

- California: Good news—California doesn’t tax lottery winnings at the state level, but you’ll still owe federal taxes.

- New Hampshire and Tennessee: These states don’t have general income tax, but that won’t save you from paying federal taxes.

- Other States: Many states will take a cut. Depending on where you live, that could range from 0% to over 8%.

And remember, five states don’t have lotteries at all: Alabama, Alaska, Hawaii, Nevada, and Utah.

Request Your Free Consultation

Lump Sum vs. Annuity Payments

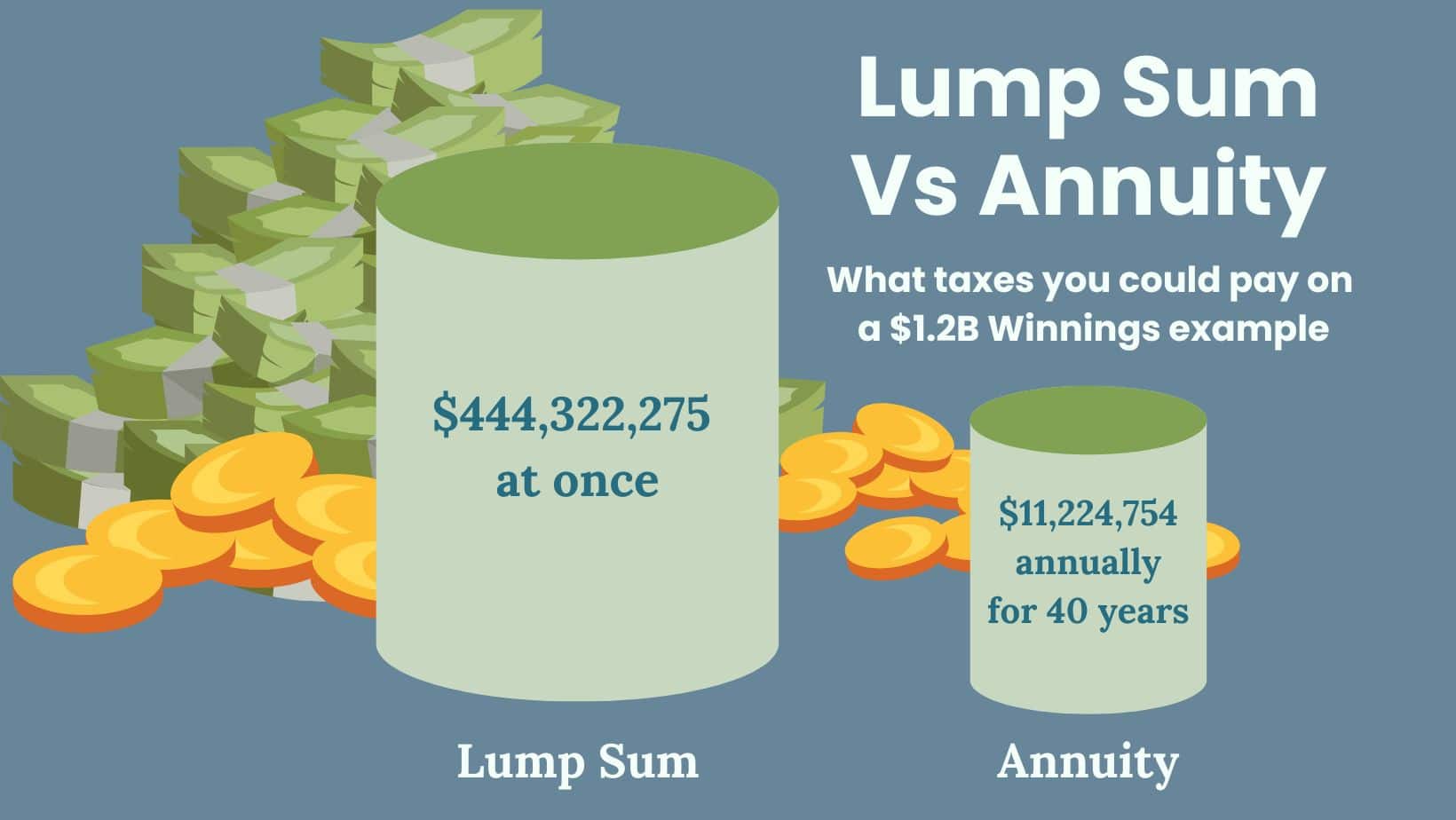

Once you win, you’ll have a big decision to make: take the money as a lump sum or spread it out over time with an annuity. Here’s how taxes factor into each option:

Lump Sum

If you take a lump sum, you’ll receive the full amount of your winnings at once, but be prepared for a hefty tax bill. Let’s say you win $1.2 billion. If you choose the lump sum, you’ll be pushed into the highest federal tax bracket—37%. That means a huge portion of your prize will go directly to taxes. But don’t worry, not all of it is taxed at 37%. Each portion of your income gets taxed at different rates based on current tax brackets. For example, the first $10,275 is taxed at 10%, the next portion at 12%, and so on, until you reach the highest bracket.

Annuity Payments

If the thought of a big tax bill stresses you out, you can choose to take your winnings as an annuity. This spreads out the payments over time—usually 30 years—allowing you to spread out your tax liability as well. For instance, if you win $1.2 billion and choose to take $30 million per year, your annual tax burden will be much lower than taking the entire prize at once. This option can save you millions in taxes over the years, and it also protects you from overspending right away.

Minimizing Your Tax Burden

No one likes paying taxes, but there are ways to minimize the impact. Here are a few strategies to consider:

- Take Annuity Payments: Spread your tax payments over time by opting for annual payments instead of a lump sum.

- Charitable Donations: You can donate to qualified charities and deduct those contributions from your taxable income.

- Deduct Gambling Losses: If you’ve lost money gambling, you can deduct those losses from your winnings, but only up to the amount you’ve won.

- Gifting Winnings: Be mindful of gift tax rules if you’re planning to share your prize with family or friends.

Again, working with a tax advisor is essential to navigate these complexities and ensure you’re maximizing your winnings in the most tax-efficient way possible.

Conclusion

While hitting the jackpot sounds like the ultimate dream, it’s important to remember that taxes are a big part of the equation. Whether you take your winnings as a lump sum or an annuity, having a solid plan in place will help you manage your money wisely. And if you’re not sure where to start, don’t hesitate to consult with a tax professional who can help you navigate this exciting but complex journey.

For more information on gambling income and losses, visit the IRS website at IRS Topic No. 419.

Winning the lottery may be life-changing, but it doesn’t have to be overwhelming if you plan ahead!

Did You Know?

A staggering 70% of lottery winners end up broke within a few years! It’s not just about winning—it’s about smart money management. With careful planning, you can avoid becoming a cautionary tale.

Frequently Asked Questions about Lottery Taxes

How are lottery winnings taxed at the federal level?

Lottery winnings are treated as taxable income by the federal government. Typically, 24% of large prizes is withheld immediately, but winners may owe more if they fall into a higher tax bracket.

Which states do not tax lottery winnings?

A few states, like California, Florida, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming, do not tax lottery winnings at the state level. However, federal taxes still apply.

Is it better to take a lump sum or an annuity?

Choosing a lump sum means you’ll receive the full amount upfront, but you might face a higher immediate tax burden. An annuity spreads payments (and taxes) over multiple years, which can lower your yearly taxable income and help manage spending discipline.

How can I reduce the taxes on lottery winnings?

Some strategies include choosing an annuity rather than a lump sum, making tax-deductible charitable donations, keeping track of gambling losses (which may be deductible), and working with a certified tax professional to optimize your tax liability.

What happens if I share my winnings with family or friends?

If you gift a large portion of your winnings, you may be subject to the federal gift tax, depending on the amount. Consult a tax advisor to understand the limits and any potential tax implications before gifting.