Harnessing the Financial Domino Effect: A Guide to Successful Debt Management

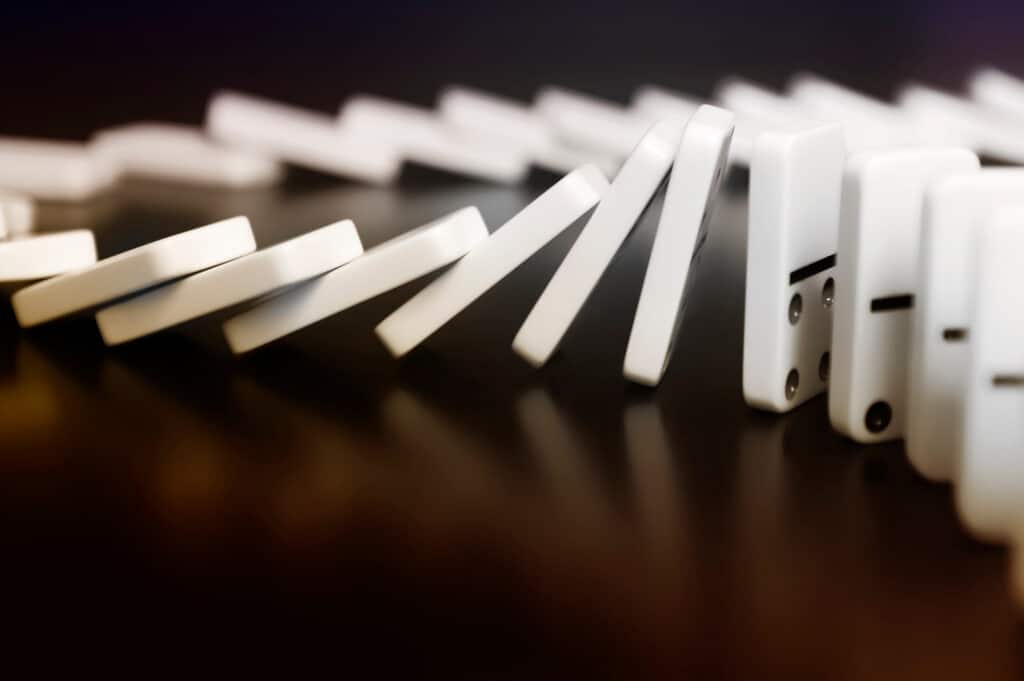

Ever thought about your finances as a set of dominoes? Each decision you make can lead to another, creating a cascade of events that can either improve or disrupt your financial stability. This concept, known as the Financial Domino Effect, can be your strongest ally when you manage it wisely. Today, we will dive deep into how this effect can be triggered through smart debt consolidation strategies. We’ll guide you through steps to organize your debts, assess your options, choose the right strategy, and trigger your own positive Financial Domino Effect, leading you towards financial freedom.

Step 1: Organize Your Debts – The Initial Domino

The starting point in this chain reaction of financial success is organizing your debts. This involves listing out all your debts, including credit card balances, student loans, car loans, or even personal loans. It’s important to gather all the details for each debt, including the balance, interest rate, and minimum payment.

Imagine it like setting up your dominoes; you need to know the shape and size of each one to strategize the layout. Similarly, having a detailed picture of your financial obligations will help you understand the scope and scale of your situation. This in-depth knowledge of your debts gives you a firm foundation to develop a strategic plan for debt consolidation. It can help you identify the most burdensome debts that should be addressed first, and guide your future financial decisions to avoid unnecessary debts.

Step 2: Assess Your Options – Evaluating Potential Paths

Once your debts are organized, the next step is assessing your debt consolidation options. Think of this as planning the path your dominoes will take. You need to consider the potential outcomes and select the path that will lead to the most satisfying domino effect.

There are several debt consolidation options available, each with its own advantages and considerations. For example, balance transfers often come with low introductory interest rates, but they can also include fees and potentially high rates after the introductory period ends. Personal loans offer a lump sum that can be used to pay off multiple debts, but they require good credit for the best interest rates.

Alternatively, a debt management program like the one Money Fit provides can consolidate your debts without needing to secure a new loan. Instead, you make a single monthly payment to the program, and they distribute the funds to your creditors on your behalf. This can lower your overall interest rates, waive fees, and help you build a more sustainable budget.

By thoroughly understanding your options, you can choose the consolidation strategy that best aligns with your financial situation and goals. The right path will set up the dominoes to fall in a positive and beneficial sequence, moving you closer to financial freedom.

Step 3: Weighing the Options for the Best Strategy – Aligning the Dominoes

When looking at your options for managing debt, it’s important to choose the strategy that best suits your unique financial situation. Debt consolidation without a loan might emerge as the most advantageous option for many, due to the multitude of benefits it offers.

By opting for a debt management program like the one offered by Money Fit, you can potentially lower your interest rates and waive late or over-limit fees. These programs are designed to work with your budget and offer an affordable repayment plan, reducing the stress that often accompanies debt repayment. Rather than juggling multiple payments, you’re left with a single, manageable monthly payment. This not only simplifies the process but can also accelerate your debt repayment and save you money in the long run.

Step 4: Initiate the Positive Financial Domino Effect

Setting up the dominoes is one thing, but the real magic happens when you tip the first one over and set off the chain reaction. The same is true with your financial domino effect.

By consolidating your debts, you can streamline your finances and create a manageable payment schedule. This is your first domino – the first major step towards regaining control of your finances. Each subsequent payment is like another domino falling, moving you closer to your goal of becoming debt-free.

Every payment made is a victory, a testament to your determination and progress. It’s a rewarding process, watching the dominoes fall one by one as you clear your debt, gain financial stability and set yourself up for a future of financial freedom.

Conclusion: Tipping the First Domino Toward Financial Freedom

We all have the power to set up our financial dominoes for success. The process might seem daunting at first, but with the right strategy and support, you can regain control of your finances and kickstart the financial domino effect. For inspiration, please check out some of our client success stories. They just might help give you the inspiration you need to get started!

Remember, it’s not just about getting out of debt – it’s about gaining knowledge and adopting the habits that will keep you out of debt in the future. By understanding your financial situation, exploring your options, and choosing a strategic plan, you’re not just tipping the first domino, you’re charting a course for lasting financial health and freedom.