How To Spend Money Effectively

Spending money wisely may seem easy, but history shows that isn’t the case.

There are many households with income problems, most household financial challenges in the US are spending problems. It is natural to think that more money will solve your financial troubles. However, human nature tells us that the more money we earn, the more money we spend.

Chew on this. Complaints about the cost of groceries takes a back seat among American consumers only to complaints about taxes and gas prices. At their core, these and other financial complaints tend to be veiled cries for help to save money (spend less). Regardless of which is more common, such spending challenges exist in most household budgets across the country.

Consider the following situations regarding spending and saving money as food for thought:

-

The same sack of groceries that requires you to work less than 1½ hours to purchase today required nearly two days of average wages back in the early 20th century. On top of that, workers spent far more hours at their place of employment back then than we do, and if you stop to think about it, it was not so long ago that most American shoppers could not even find much fresh fruit on their store’s wintertime shelves. The conclusion? Our grocery bills take up a much smaller portion of our paycheck than they did a century ago.

-

While the average home mortgage takes up about the same amount of the average American paycheck now as it did back around 1950, the home you now get for that same paycheck percentage is twice the size (and your average family is much smaller nowadays too). Consequently, children growing up today have far more than double the personal bedroom space than their grandparents and great-grandparents had just over a half-century ago.

-

Adjusted for inflation, gas is no more expensive now than it was back in the 1970s, but our vehicles are twice as fuel-efficient as they used to be. That means we can drive twice as far now as our parents and grandparents could in the 1970s on the same dollar (adjusted for inflation). Unfortunately, instead of saving money thanks to the higher gas mileage of our vehicles, our commutes and vacations have become much longer than they used to be. Commutes are now 20% longer than they were in 1980 when data on average commute time was tracked for the very first time. One can only imagine how much longer commutes are now than they were back in 1950 when grandpa, grandma, great-grandma, and great-grandpa often lived just a few short miles from their office or place of employment.

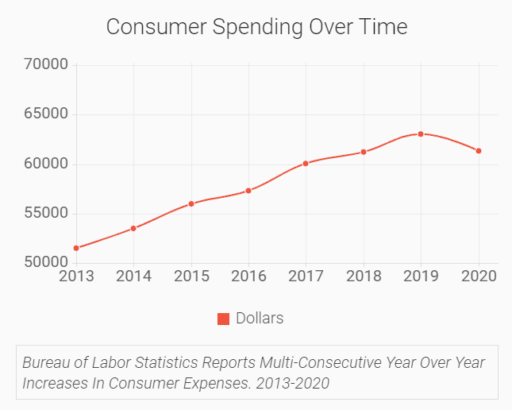

Indicative of general American consumer behaviors, the above figures illustrate the idea that we have less of an income problem in this country and more of a spending problem. In our endless pursuit of bigger, better, and just plain more consumer items, we continue to spend more rather than less, rather than saving money and making do. This also explains why less than half of American households regularly deposit even small amounts of money into their savings funds.

Developing effective and efficient spending behaviors and habits requires effort, discipline, and time. Take advantage of the resources above to get you and your household on the road to better management of the money you already have.