SIMPLE Personal Finance: Take Control of Your Money

Tired of “get rich quick” schemes and empty promises? Our S.I.M.P.L.E. approach focuses on the practical actions that actually build lasting financial well-being: Spend, Invest, Manage, Plan, Limit, Eliminate.

No Magic Formulas, Just Proven Strategies

We won’t promise overnight wealth or some secret formula known only to a select few. Instead, we’ll guide you through proven steps to take control of your money, ditch debt, and build a solid financial foundation.

Sound too simple to be effective?

Don’t be fooled by flashy websites or smooth-talking “gurus.” When it comes to your finances, simple principles consistently beat gimmicks and get-rich-quick schemes.

Ready to Take Control?

Let’s dive into the SIMPLE Personal Finance System and build a stronger financial future, one step at a time.

S – Spend Wisely

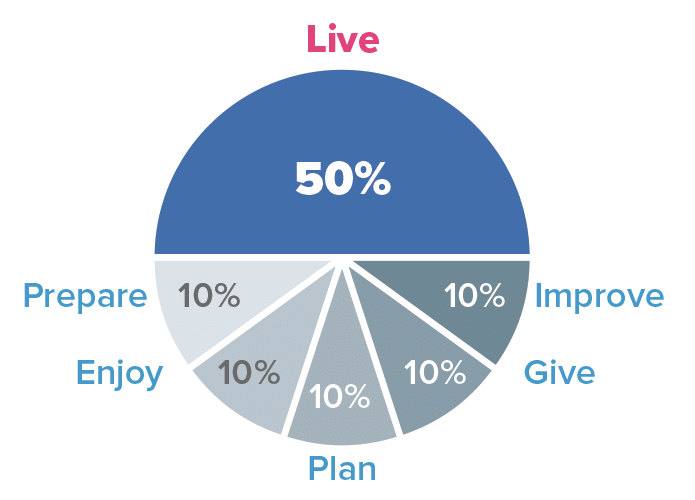

Spending money is inevitable, but it doesn’t have to control you. “Spend Wisely” isn’t about deprivation or endless budgeting. It’s about aligning your spending with what truly matters to you. This means prioritizing your needs, setting realistic limits, and making every dollar work towards your goals.

- Prioritize Needs: Ensure your essential expenses (housing, food, transportation) are covered first.

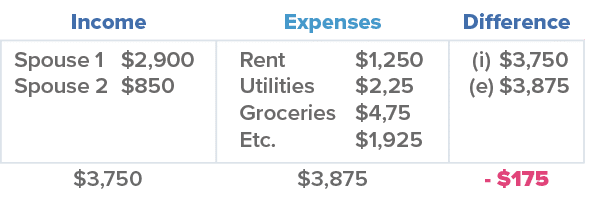

- Set Limits: Avoid impulse purchases and unnecessary spending. Create a budget to track your income and expenses.

- Align Spending with Goals: Your spending should reflect your financial aspirations. Save for that dream vacation or prioritize your retirement savings.

I – Invest Regularly

Imagine a world where your money works for you, even while you sleep! That’s the power of investing. Whether you’re just starting out with small amounts or building on an established portfolio, consistent investing is key. It allows your money to benefit from the long-term growth potential of the markets.

- Start Early: The power of compound interest means early investing is crucial.

- Choose Your Risk Tolerance: Different investments have varying risk levels. Do your research and invest according to your comfort zone.

- Automate Contributions: Set up automatic transfers to ensure consistent investing, even with small amounts.

M – Manage Debt Strategically

Debt doesn’t have to define your financial future. With strategic management, you can regain control and create a pathway to becoming debt-free. This involves understanding your debt landscape, prioritizing high-interest balances, and exploring options that best fit your individual situation.

- Prioritize High-Interest Debt: Focus on paying off debts with the highest interest rates first.

- Develop a Repayment Plan: Create a strategy to steadily reduce your debt, considering debt consolidation if it makes sense for you.

- Avoid Unnecessary Debt: Only borrow for essential needs and avoid impulse credit card purchases.

P – Plan for the Future

What does your ideal future look like? Whether it’s a comfortable retirement, owning a home, or leaving a legacy, planning creates a roadmap to make your dreams a reality. It involves setting clear goals, creating a savings strategy, and protecting yourself and your loved ones against the unexpected.

- Set SMART Goals: Specific, Measurable, Achievable, Relevant, and Time-bound goals will keep you focused.

- Consider Retirement Savings: Start saving for retirement early, taking advantage of employer-sponsored plans like 401(k)s.

- Protect Yourself: Consider disability and life insurance to safeguard your financial future in case of unforeseen circumstances.

L – Limit Risk

Smart financial growth requires a balance of risk and reward. Limiting risk helps protect your hard-earned money from unnecessary losses. This includes strategies like diversifying your investments, building a solid emergency fund, and carefully considering the level of risk that fits your goals and timeline.

- Diversify Investments: Don’t put all your eggs in one basket. Spread your investments across different asset classes to minimize risk.

- Build an Emergency Fund: Aim for 3-6 months of living expenses saved to cover unexpected costs.

- Review Regularly: Regularly assess your financial situation and adjust your risk tolerance and investment strategies as needed.

E – Eliminate Waste

Think of all those unused subscriptions, impulse purchases, and forgotten fees draining your bank account. By eliminating wasteful spending, you free up precious resources that can be redirected towards debt elimination, investing in your future, or simply enjoying life more fully.

- Review Subscriptions: Audit your monthly subscriptions and cancel unused services.

- Negotiate Bills: Don’t be afraid to negotiate your bills, like cable or internet services.

- Plan Your Meals: Reduce impulse purchases and save money on groceries by planning and preparing meals at home.

The path to financial well-being isn’t paved with secret formulas or overnight riches. It’s built with steady steps, intentional decisions, and a commitment to progress over perfection. The SIMPLE principles provide a framework, a guiding light for your journey.

As you start to spend wisely, invest consistently, manage debt strategically, and plan for the future, something incredible happens. The burden of financial stress begins to lift. A sense of control and possibility starts to take root. You begin to realize that your financial goals, whether it’s homeownership, a secure retirement, or simply peace of mind, are within reach.

Remember, this is YOUR financial journey. There will be setbacks and challenges along the way. Embrace the process of learning, adjusting, and celebrating the milestones both big and small. Seek support when you need it, and don’t be afraid to revise your plans as life unfolds.

The SIMPLE personal finance principles are not a magic trick. They are a proven path, designed to empower you to take charge of your money and create the life you envision. Are you ready to begin?

Resources for Your Financial Journey

Explore the various sections of the Money Fit website for further information on the SIMPLE principles and find valuable tools:

-

- Budgeting:

- Investing: Articles and resources on investing basics, risk assessment, and long-term strategies.

- Debt Management: Guidance on debt repayment strategies, debt counseling options, and tools for creating a personalized plan.

Additional Resources:

-

-

- National Foundation for Credit Counseling | Money Fit is proud members.

- Financial Counseling Association of America | Money Fit is proud members.

- Money Fit Academy | Consider enrolling in relevant courses on the Money Fit Academy to deepen your financial knowledge and gain practical skills.

-