How to Save Money in a Practical Manner

Forget what your parents, teachers, and friends told you about how you should save money for emergencies before you do anything else. Forget what financial experts say about building an emergency fund worth three to six months of your expenses. Forget about any numbers or figures or dollar amounts that radio shows and podcast hosts recommend you save.

Here is the problem with a majority of the saving money advice we routinely see: they treat saving money as if it were a number to compute or an account to open. It is not.

Savings is one thing and one thing only: Savings is a Commitment.

Pure and simple. Most American households can afford to save money each month, so why don’t they? It is not because of the dollar amount. It’s because of the commitment.

You prioritize what you commit to in life. Most people commit to anything they see as immediately beneficial to them or to those they love. Even though you do not think about it, you are committed to breathing. You do not count your breaths per minute. You do not measure the volume of oxygen you inhale. You are committed to breathing and you just do it. Whatever it takes. Saving is the same way. If you are committed to saving, you will just do it. You will care less about how much you save with each paycheck. You will worry less about how much you have in your accounts. You will, instead, automatically save something every time you receive income.

How to Commit to Saving Money

This analogy begs the question, “how do you commit to savings?” You involuntarily commit to breathing, even as a newborn. You can choose to stop breathing, at least until you pass out. Then, you start breathing again. What about savings? How do you make savings as involuntary as breathing? The following seven steps will take you through the process of first making your savings meaningful, then making your savings reliable, and finally making your savings as involuntary as possible.

7 Steps to Making Savings as Easy as Breathing

Depending upon the survey or study you read, anywhere between 60% and 80% of Americans are living paycheck-to-paycheck, meaning they have nothing left over at the end of the month to save or invest. For many of these households, savings seems like a fantasy, like running a marathon might seem to most adults. The reality is that it will take an initial commitment and ongoing commitment (action) to make savings a reality and a success. Making the transition from paycheck-to-paycheck to a regular habit of saving can become as natural as breathing. Follow these steps, and you will find yourself saving with no more thought than you give to the expansions and contractions of your own lungs.

1. Identify Savings Goals

To begin your commitment to savings, you must make the process as meaningful as breathing. You know that if you don’t breathe, you start to hurt and even black out. You will also likely end up with a major headache when you wake up.

What to Save Your Money For:

Everyone knows that having an emergency savings account can prevent major financial headaches, or at least remove much of their pain and sting. Setting additional savings goals for short-term wants will also remove much of the pain from your personal finances. From vacations and gift-giving to appliance repairs and your next car, there is seemingly no end to the things you should be saving for.

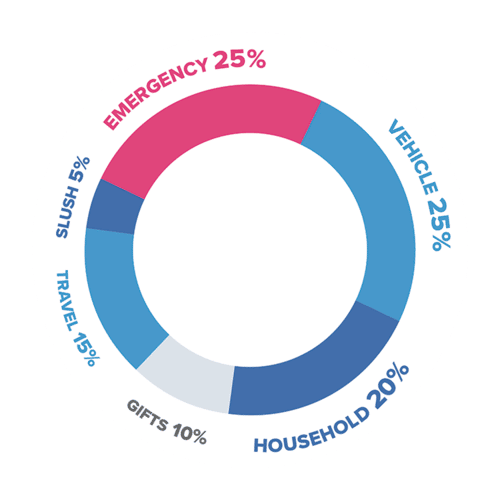

Use our Savings Pie calculator to determine how much of your savings will go to each savings category. If you are unsure how much money in total you should or could be saving, check out our Money Pie Budget Calculator.

Emergencies (25%): For periods of unemployment or in times of financial crisis caused by unplanned spending on medical or health necessities

Vehicles (25%): For extensive vehicle repairs as well as for purchasing your next vehicle

Household (20%): For repairing or replacing appliances and furniture, as well as for planned home and yard improvements

Gifts (10%): For gifts for birthdays, weddings, Christmas, or other holidays

Travel (15%): For vacations and out-of-town trips

Slush (5%): For unexpected but advantageous spending opportunities, such as finding the “deal of a lifetime” on an item or experience you had not planned on purchasing but decide you want after all

2. Use Separate Financial Institutions

As mentioned in the Savings Pie above, using savings accounts and certificates of deposit at financial institutions (banks and credit unions) that are separate from where you keep your checking account can be a powerful tool to keep you heading down the savings path. Too many adults make an attempt to save by transferring money to a savings account connected to their checking account, only to find they transfer the entire amount back to their checking mid-month because they had gone out to a nice dinner, gone out for a movie, or made another impulse purchase that they needed to cover with their savings. After a couple of months, they assume they are not savers or do not have what it takes to become savers. So, they give up and go back to their comfort zone of living paycheck-to-paycheck. They eventually accept the falsehood they tell themselves about not being a saver, because who wants to feel like a failure? Nobody. To minimize this possibility, find another bank or credit union where you can open savings accounts for your savings funds.

Make It Inconvenient to Get to Your Savings

You can understand the power of separating your checking from your savings accounts. To take this further, though, you need to make it as inconvenient as possible, without making it impossible, to access your savings. Here are some things to look for in a bank or credit union that would be an ideal place to park your savings and let them grow unmolested. Find a financial institution that:

-

does not issue you an ATM or debit card.

-

has no drive-through lane.

-

has no fees and no minimum balance requirements for savings accounts.

-

is nowhere near your home or place of work. Having only one branch is great. Being an online-only financial institution is also highly recommended.

-

keeps limited banking hours (no evening or weekend hours).

-

offers remote deposit of checks.

-

you connect to your paycheck through direct deposit.

-

you do not connect electronically to your checking account bank or credit union.

Once you have found the right fit in a bank or credit union, it is time to open your savings accounts. If you are wondering how many to open and how much to put into each, the next step is for you.

3. Open a Separate Saving Account for Each Goal

Another challenge many would-be savers face is figuring out how much of their savings is for which purpose since they put it all in one account. Think about it. If you have been saving for emergencies, a vacation, and Christmas gifts over the past five months, and summer rolls around, your natural question will be, “how much of this $1,500 is for our summer vacation, and how much is for the other goals?” Human nature would lead you to answer, “All of it is for my vacation next month!” You then justify this savings raid by saying you will get “caught up later” on your Gifts and your Emergency funds. The truth, though no one likes to admit it, is that you would never get caught up. When Christmas rolls around, you would spend the entire savings on gifts.

To get past this temptation, the simple answer is to open multiple savings accounts. In fact, open a new saving account for each of your major savings goals. That would include a saving account for your emergency funds, one for your travel and vacations, one for car repairs and replacement, one for appliances and furniture repair and replacement, one for gift-giving, and one for all other unexpected but important purchases.

Look at your savings pie above and open a separate saving account for each piece of the pie. Some will argue that having multiple savings accounts will become too confusing and too overwhelming to track. The reality is that with a separate account for each savings category, you will likely have just one or two deposits a month into each account. That can actually simplify the process of tracking your money and determining whether you have made your monthly deposits yet or not.

4. Give Each Account a Name… the Scarier the Better

This step is critical but not even considered by many savers. If you go through the trouble of setting up multiple savings accounts at a second financial institution and make some initial deposits, you may get confused the next time you look at the accounts because you have forgotten what they are each for. Here is where naming your accounts becomes so critical.

Virtually all banks and credit unions will allow you to give your accounts unique names, rather than designating them solely by their account numbers.

To simplify matters, you can use the savings categories above as names for your accounts:

1. Emergencies, 2. Vehicle, 3. Household, 4. Gifts, 5. Travel and 6. Slush.

Such names should suffice for many savers. However, for those who are still tempted to raid their savings mid-month to pay for impulse spending, consider names that are a bit more intimidating for would-be raiders:

-

Instead of “Emergency,” consider something like, “Save from homelessness in case of job loss.”

-

Instead of “Vehicle,” give it the name of the vehicle you really want next.

-

Instead of “Household,” consider the name, “No More Wasted Food in Run Down Fridge.”

-

Instead of “Gifts,” name the account, “Without this Money, Santa Doesn’t Show Up This Year.”

-

For the travel account, give it the name of your desired vacation destination, such as, “Mickeyville or Bust.” You might even add a date, like “European River Cruise 2025.”

Do not worry about what others will think of the names. They are meant for you and to motivate you to leave the money in your savings while watching it grow.

5. Commit to Save from Every Income Source

One of the oddities of human nature is that it is easier to commit to doing something 100% of the time than it is to do it 99% of the time.

If you have committed to saving something each and every time you receive income, it becomes automatic and you do not need to argue with yourself about whether you can afford it. However, if you commit to saving 99% of the time, you will also dither and dicker with yourself, wondering if this is the 1% of the time you should not save. Your mental and emotional exhaustion will eventually overcome your willpower to save anything at all.

Consequently, consider saving a portion of every bit of income you receive, from wages and salaries to gifts to tax refunds to that $200 you forgot your brother-in-law owed you from three years ago until he just paid you this morning.

Save something from every dollar every time. After all, you do not think about how much oxygen you want to get from each breath. You just breathe one breath after another.

6. Automate Transfers and Deposits

As you approach your final steps, you should recognize that what you are building is not just a habit but a system for saving money automatically. This step fills a central requirement of the system.

You must automate your savings deposits to happen every month into each of the savings accounts. You have a few options:

First, you can have money directly deposited from your paycheck into your savings accounts. Many employers limit the number of direct deposits to two or three per month, so you might consider depositing all of your savings into a single savings account. Thereafter, you may move the specified amounts into their own accounts.

Second, you can set up automatic transfers into your savings accounts. Do not fear that just because your savings accounts are held at a bank or credit union separate from the checking account that you cannot set up automatic transfers. Instead of transfers between accounts, you can set up transfers using your bank’s or credit union’s online bill pay option. With your savings account and routing numbers and the address of the branch where your savings accounts are held, you can set up recurring monthly bill payments that will be deposited into your savings.

Timing is critical for either method. Set up the transfers or bill payments to happen just two or three days after your payday. This allows for variations of deposit dates when your payday falls on a weekend or a holiday. Do not delay too long after your payday, though. The longer your money sits in your checking account, the more likely you are to spend it impulsively.

7. Accelerate Your Savings Funds with PowerCash

Finally, if you feel your deposits are insufficient to make much of a difference in your savings, consider the only way to accelerate your savings: deposit more money each month into your savings.

Not possible, you think? Perhaps you feel you are already depositing as much as you can. Use our PowerCash calculator to help you find an additional $50 to $200 that you can deposit into your savings each month with minimal pain or discomfort to your normal spending.

PowerCash works like this: estimate how much you spend on groceries, dining out, entertainment, gift-giving, and other discretionary expenses during an average month. Then, take just 10% of that amount and transfer it to your savings as soon as payday comes. For a typical household spending $600 on groceries each month, this means it will have to adjust to $540. That is less than $600, but with a minimal amount of adjustments and discipline, it is very achievable.