Personal Finance Presenter

Looking for an energetic and compelling speaker for your upcoming webinar, conference, meeting, or event?

Todd Christensen and his team of financial educators have a passion for improving the lives of others and are ready to share their extensive financial knowledge tailored to any audience in most any setting. Read on to learn more about their mission and in what ways their workshops can benefit you.

Here's My Commitment

What You Can Expect from Me as a Speaker

I will give you my very best effort to make your event a success and help you reach the objectives you’ve set. Your success is how I measure my success.

Prompt, professional replies to your online inquiries and your phone calls and email messages.

A virtual or phone consultation with me and/or a member of my team prior to your event, in order to put together the best program for your audience.

A customized presentation prepared and delivered (typically 60 minutes in length but available between 15 and 90 minutes) with energy and professionalism in order to achieve the objectives you’ve identified for your event.

A virtual or telephone debriefing after the event with myself or one of my team members, to address follow-up requests and to ensure your event expectations were met.

Available Topics

Here’s a sampling of the possible presentation topics. Remember, if you don’t find what you are looking for, we’d be happy to customize your workshop content, just ask!

1. Everyday Money for Everyday People

Great for the general audience, from teens to seniors, beginners to the rest of the 60% of Americans living paycheck-to-paycheck (or worse). This presentation addresses Values, Generosity, Expense Planning, Credit, Debt, and Savings. By the way, HOW do you move your household budget from Friend to Frenemy? And WHY does good credit still matter, even if you’re not buying a new home anytime soon.

2. Everyday Money for Everyday Zombies

Like our Everyday Money for Everyday People presentation, but for Zombies. Get it? Financial Zombies, like the rest of the undead, wander about seeking only to consume, without apparent reason or rationale, and are never satisfied. But is it possible to bring one back from the financial undead? There is always hope!

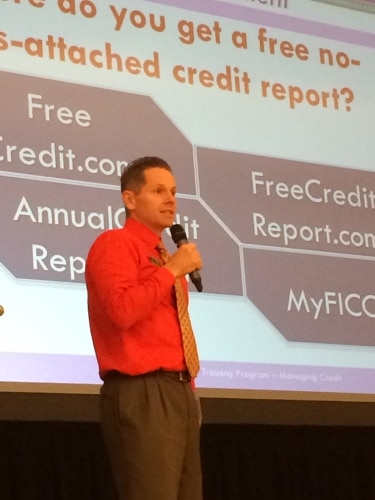

3. Credit and the Interest Insomniac

Credit is one of the least understood topics related to personal finance, yet still, one on which we tend to fixate as a society. This enlightening presentation reduces this complex topic to a single word while also providing details of what to look for on your credit report and what the most influential factors are of a credit score.

4. Young and Financially Empowered: Must-Have Financial Lessons for Those in Their 20s

From student loans and credit card debt to pawn loans and rent-to-own contracts, young adults deal with financial challenges that, while not unique to their demographic, can affect their generation in uniquely crushing ways. This presentation addresses financial issues that are very specific for young adults and offers ideas for preventing and addressing financial problems. By helping young people to recognize signs of impending financial troubles, grasp the consequences of excessive debt, and understand their options for dealing with debt, this presentation empowers the twenty-something crowd to build a strong foundation for wise financial decisions for the rest of their lives.

5. Who Wants to Live Like a Millionaire? Monkey See or Monkey Do?

A self-awareness workshop and activity to help participants connect their opinions and attitudes to their financial choices and corresponding consequences. Let’s busts some millionaire myths, confirm some basic beliefs, and commit to healthy financial behaviors.

6. Avalanches, Cascades, Landslides, and Snowballs. Do It Yourself Debt Relief Options

Let’s have a lively and practical discussion of four do-it-yourself debt repayment options: 1) The Debt Avalanche: Attacking debts in order of highest to lowest APR to save the most money and pay off soonest, 2) The Debt Cascade: Setting future monthly payments by your current monthly minimum payments for those not able to send additional cash, 3) The Debt Landslide: Attacking debts in order of newest to oldest to rebuild credit fastest, and 4) The Debt Snowball: Attacking debts in order of smallest to largest to generate continued motivation through small, early wins.

7. For Richer or for Poorer… but Hopefully for Richer: Newlywed Finances

Money is the single most common subject of arguments in marriage and can quickly end the honeymoon even for newlyweds. Forget the crystal punch bowls and the matching dishtowels, give your newlyweds the gift of a lifetime of financial teamwork and cohesion by sending them to this class.

8. Spending by Color

This fun and insightful workshop will begin with a brief 30-question self-evaluation of each of our own spending personalities (yes, most of us have multiple spending personalities, and that’s okay).

Together we’ll identify six major spending tendencies and motivations to which we may be susceptible. Each is assigned a color and discussed in depth. There’s not necessarily one color to which we should aspire over another. Rather, each color is a part of us throughout our lives. However, some colors do present greater enticements for overspending than do others.

9. What’s New the Year in Consumer Credit Reports and Scoring?

Your credit score can change each time it is generated. Changes are normal and expected. Changes in the credit rating system are also normal and should be expected. If your audience could use a refresher with an update on recent changes to credit reporting and credit scoring, this session is for you. From free Security Freezes to Experian’s 2019 Boost product, from changes in the FICO 9 and VantageScore 3.0 & 4.0 formulae to the types of data no longer listed on credit reports (e.g. judgments, tax liens), changes are afoot. Get up-to-date with this presentation.

See more presentations and access our webinars here.

What Others Are Saying About Todd’s Presentations

Speaking Engagement Letters of Recommendation

USDA - F.X. O' Connor, Jr

AFCPE - Rebecca Wiggins

Financial Beginnings - Dr. Melody Bell

Education Fee Schedule

Online Library of Self-guided Courses

-

Pre-recorded Video Courses FREE

-

Interactive Activities FREE

Virtual Presentations

-

Scheduled-hour presentation* $495

Discounts available*

In-Personal Presentations and Speaking Engagements

-

Per travel day (up to 4 hours of live engagements) $995

Includes Travel, Lodging, and Meals Paid by Host

Recording of Virtual Presentations

-

Per half-hour $95

Edited, co-branded, and electronically delivered

Everyday Money for Everyday People Book†

-

1-10 copies $15.00

-

11-100 copies $10.00

-

101-500 copies $8.00

-

500+ copies (custom Forward) $6.00

Housing Education Courses

-

See Separate Fee Schedule

* 50% for 501(C)3 Agencies, Nonprofit Schools, and Government Agencies

† Includes shipping within continental US

Book Todd to Present at Your Next Event

About Todd Christensen

As an Accredited Financial Counselor and author of Everyday Money for Everyday People, I have a decade of experience speaking as a personal finance expert for large and small groups. I have facilitated over 1,000 presentations, classes, and workshops for tens of thousands of participants, keynoted conferences, led a score of conference breakout sessions, been interviewed for television shows, newspaper columns, and magazine articles, and have served in financial literacy leadership positions across the country.

Since 2004, I’ve served as Education Manager at Money Fit by DRS, Inc., a nationwide nonprofit credit counseling agency. As the Author of Everyday Money for Everyday People (2014), I also develop educational programs and produce materials that teach personal financial skills and responsibilities. I have served in executive, board, and committee leadership positions with the Idaho Jump$tart Coalition, the Association for Financial Counseling and Planning Education, and the American Association of Family and Consumer Sciences. I also volunteer on the program coordinating committees with three affordable housing authorities. Additionally, I hold two Master’s degrees, including Master of International Management.

Whether speaking to large groups (such as to 600 women at the Smart Women Smart Money conference in Boise, ID in 2012, 2014 & 2018) the general session of annual conferences, keynoting commencements at schools or work training programs or facilitating classrooms and small business employee training meetings, I take great satisfaction and professional pride in inspiring others to make financial changes for the better in their lives. I have published articles and booklets addressing topics ranging from marriage and money to raising financially smart children, from recovering from bankruptcy to controlling holiday spending.

I also served as a volunteer Spanish and French language interpreter at the Special Olympics World Winter Games in Boise, as an evaluator of the Pre-Professional Certification Test for the American Association of Family and Consumer Sciences, and have served frequently as a financial education awards judge for various conferences and associations. In Idaho, I also participated as the sole public member of the committee that developed the course standards for Idaho’s Mathematics of Personal Finance high school course. As an eagle scout myself, I have also served in multiple adult leadership positions in scouting.