Be careful when looking into app-based loans.

Promises of zero percent interest? What could go wrong?

Why wouldn’t consumers jump into 0% interest loans through new app-based lenders?

Since COVID had slashed foot traffic to traditional brick-and-mortar stores, online shopping has skyrocketed along with innovations in payment alternatives. Among these new developments, you will find small-dollar amount installment loans you can repay monthly without paying interest.

Although growing in usage, 0% interest installment loans through companies like Affirm, Afterpay, and Klarna will still lead a large portion of consumers to overextend themselves in debt. Many borrowers will also run into high late-payment fees or negative effects on their credit rating.

Recently launched apps that offer zero-interest, short-term loans for making in-store purchases have exploded onto the consumer scene this year. Store after store is teaming up with these apps to offer their customers a 3-, 4-, or 6-month financing option at the checkout stand. All proponents of these services focus almost exclusively on the 0% interest, not on the amount of debt the consumer is accruing. It’s still debt, which can overwhelm any household budget at high levels.

It’s Still Debt

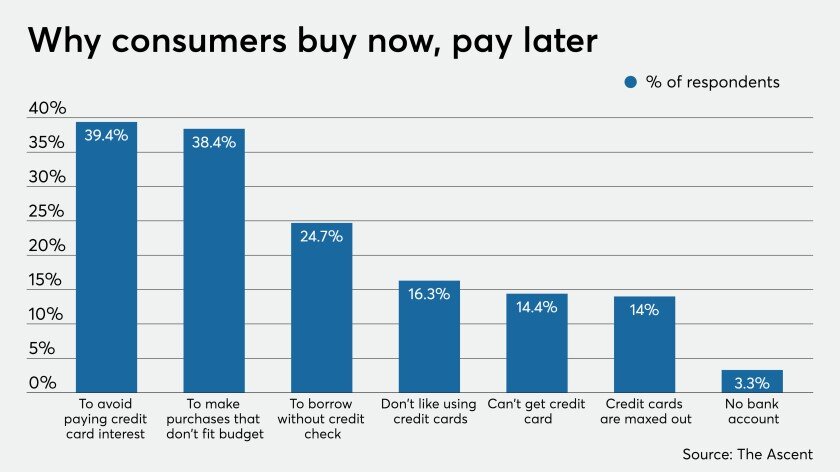

Looking at the chart from The Ascent, consumers clearly use debt vehicles like credit cards and new zero-interest loan apps to make purchases they can’t afford. Add the 38.4% who make purchases that don’t “fit” into their budget to the 24.7% who don’t want a credit check (usually because their credit rating fits the description of “precarious” due to debt troubles), then add another 14.4% who can’t get a credit card (almost always due to poor past debt issues or to be new to credit), and finally add the 14% who already have a maxed out credit card or two. Since respondents could choose more than one answer, the total of consumers who buy now and pay later because of debt troubles falls somewhere between 38.4% and 92%. Even at 38.4%, that means more than one in three borrowers cannot afford the purchase but place it on credit in order to pay for it later.

What would lead anyone to believe that delaying the payment improves anyone’s ability to repay the loan? Many of these households incur so much consumer debt that their minimum monthly payments already max out their budget. In such cases, high-interest rates might make things worse, but low or 0% interest rates on loans will not fix the problem.

To be direct, zero-interest loans will not solve over-borrowing problems. In fact, such low-interest and easy-to-access credit programs will actually accelerate the household debt. High debt balances mean larger minimum monthly payments which raise the likelihood of missed payments and a household’s inability to pay for basic needs.

Great for Retailers

Companies that have created and who manage these apps will earn revenue from fees and from agreements with retailers. Good for them!

Credit card companies may lose a lot of business to these options when consumers choose to use these apps because they offer greater clarity with regard to the resulting debts but also because of their ease of repayment when compared to credit card purchases. Credit card companies have long prospered by charging interest month after month on consumer purchases that happened months or even years in the past. Too bad for them!

Consumers as a whole will use these apps to fuel overspending, not lower debt levels. Higher debt balances will mean more missed payments, larger monthly installment payments, and less money to spend on their needs and wants. Not so good for them!

Retailers will minimize the credit card transaction fees they currently pay while increasing sales due to these new and easy-to-use services that promote consumer spending. Great for them!

Rather than laud these services as benefits for consumers, we need to keep in mind who benefits from them and who does not. Retailers stand to benefit most, followed by the app companies, while consumers will likely incur more debt, and credit card companies will lose business.

It Will Impact Your Credit

Zero-interest loans and low-interest loan apps will likely lead to changes in borrowers’ credit ratings. Interest rates play no direct role in credit scores. The FICO score considers a consumer’s payment history, the status of their debts, how old or how new their accounts are, and how much the consumer carries month-to-month on their account balances. However, of the 132 FICO score factors, not a single one refers to or looks at interest rates.

Consequently, these new zero-interest loans will have no direct effect on consumer credit ratings. However, as consumers’ debt balances rise and they begin missing payments because of over-indebtedness, credit scores will likely begin dropping.

Late Fees

These zero-interest loans do not always come without related fees. For example, Klarna charges a $7 monthly fee if the consumer misses a payment. For a $500 purchase, a $7 monthly fee equates to an $84 annualized fee or a 17% APR.

The app, Affirm, currently charges no late fees. Instead, Affirm actually charges interest on their small loans.

Afterpay charges an initial $10 late fee but will add another $7 fee if the payment does not arrive within a week of its due date. Afterpay also caps their late fees so that they do not amount to more than 25% of the original purchase amount.

Additional Fees

Besides late fees, some apps and loan services charge “origination” fees, meaning they charge you a fee at the time of purchase, as well as monthly membership fees. Although membership-based apps advertise their low 0% APRs on loans, their membership fees basically raise even these 0% APRs to anywhere from 10% to 50% interest rates, depending upon how much debt you have incurred.

Related Questions

Should I transfer my credit card debt to a low APR personal loan?

While you might qualify for a personal loan with a lower interest rate than your current credit card interest rates, beware of the dangers of running up the balances of the recently-paid off credit cards back up to their previous amounts.

Can I transfer a loan to an interest-free credit card?

If you have a credit card that offers interest-free balance transfers, or if you have excellent credit (typically 750 or 760 FICO or higher), you might qualify for a credit card that offers 0% APR on balance transfers for a limited time. Many credit cards also offer low-interest balance transfers.