Kohl's Card Credit Card Debt Relief

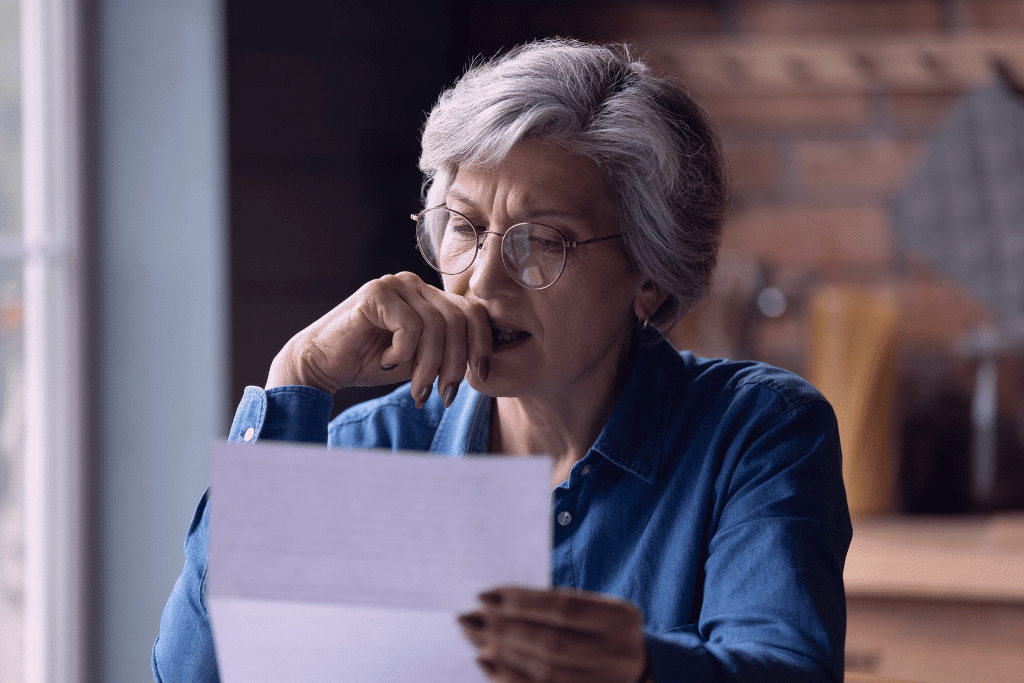

Struggling with Kohl’s credit card debt? Money Fit offers nonprofit debt management plans and counseling to help you regain financial control.

Fill out the form for your confidential, no-cost credit counseling session.

Start your journey toward debt relief today!

Here are Just a Few of the Major Credit Card Companies Money Fit Works With for Consolidating Debt:

The Money Fit debt management program isn’t a new loan substituting your existing debts. We’re your ally, actively negotiating with your credit card companies to alleviate your financial burden.

Kohl's Credit Card Debt Relief & Counseling Services

If your Kohl’s Credit Card debt has become overwhelming, Money Fit is here to support you. Our nonprofit credit counseling and personalized Debt Management Plans (DMPs) can simplify your payments, lower interest, and help you become debt-free. While we’re not directly affiliated with Kohl’s or its card issuer (Capital One), we’ve helped thousands of consumers facing similar retail credit challenges.

Managing Your Kohl's Credit Card Debt

The Kohl’s Credit Card offers significant discounts, exclusive offers, and rewards for regular shoppers. However, carrying a balance month-to-month can quickly lead to mounting interest charges and financial stress. If your Kohl’s card debt feels unmanageable, our nonprofit counselors are ready to provide assistance.

Beyond Counseling: Your Path to Debt Relief

We understand the crushing burden of high-interest debt. That’s why we offer more than just advice. Our debt management plans, created in partnership with creditors, can significantly lower your interest rates and fees, potentially saving you thousands.

Imagine getting out of debt years faster. This is possible! A personalized debt management plan can put you back on track with affordable payments.

Get Help with a Wide Range of Debts

Struggling with more than just credit cards? Our debt management plans can help you tackle:

- Credit card debt

- Payday loans

- Past-due utilities

- Collections accounts

- Medical debt

Credit Counseling

Why Credit Counseling Matters

Credit counseling is more than advice — it’s a chance to take control of your financial future with support from someone who’s on your side.

At Money Fit, our certified counselors help you:

- Understand your debt and budgeting options

- Lower interest rates through debt management plans

- Avoid bankruptcy and get back on track

We work with your creditors directly to make repayment manageable, so you can breathe a little easier and start moving forward.

Ready to take the first step? Schedule a free, confidential consultation with a certified counselor today.

Learn More About Credit Counseling

How a Debt Management Plan (DMP) Can Help

By including your Kohl’s Credit Card in a Debt Management Plan, you may:

Significantly reduce your interest rates

Consolidate your debts into one affordable monthly payment

Eliminate late and penalty fees

Have a clear and structured path to debt freedom (typically 3–5 years)

Why Choose Money Fit for Kohl's Debt Relief?

Nonprofit Trustworthiness: We offer unbiased counseling focused purely on your financial wellness.

Personalized Strategies: Debt solutions specifically tailored to your individual financial circumstances.

Consistent Results: Proven track record helping thousands successfully manage and eliminate their debt.

About the Kohl’s Credit Card

Issued by Capital One, the Kohl’s Credit Card provides regular customers with valuable discounts, Kohl’s Cash, and exclusive shopping events. While popular for savings, maintaining balances can lead to significant interest charges if not managed carefully.

Kohl’s Credit Card Contact Information:

Customer Service Phone: 1-800-564-5740

Website: www.kohls.com/credit

Tips for Managing Kohl’s Credit Card Debt

Pay Above Minimum Payments: Helps reduce total interest and speeds up debt repayment.

Track and Budget Spending: Monitoring your monthly statements helps you avoid overspending.

Seek Professional Help Early: Addressing debt early provides the most effective relief options.

Take the First Step Toward Financial Freedom

Don’t let Kohl’s Credit Card debt continue to cause stress. Reach out to Money Fit today for a confidential, free consultation, and start your journey toward a debt-free future.

How Money Fit Can Assist with Your Kohl's Credit Card

Frequently Asked Questions:

Can my Kohl’s Credit Card be included in a Debt Management Plan? Yes. Kohl’s Credit Cards issued by Capital One are typically eligible for inclusion in a Debt Management Plan, subject to your account status.

What benefits does a Debt Management Plan provide? A DMP helps by reducing interest rates, consolidating payments, eliminating fees, and providing a structured debt repayment plan.

Will a DMP affect my credit score negatively? Initially, your score might dip slightly, but consistent, on-time payments through the DMP typically result in credit score improvements.

Is Money Fit’s initial consultation really free? Yes, the initial consultation is entirely free. If you decide to enroll in a DMP, there may be a small monthly administrative fee.

Can I still use my Kohl’s Credit Card during the DMP? No. Credit cards enrolled in a Debt Management Plan are usually closed to new charges to promote successful debt repayment.

Money Fit Insights: Strategies for Financial Success

Empower yourself with expert advice on budgeting, debt management, and building wealth.