How to Dispute a Debt in Collections Step-by-Step

A collections notice lands in your mailbox—maybe the amount looks wrong, or the debt doesn’t ring a bell. It’s unsettling, but you’re not powerless. Disputing a debt in collections is a straightforward process that can correct errors, stop harassment, and ease financial strain. As a nonprofit credit counseling organization, Money Fit equips you with the knowledge and tools to act decisively. This article delivers a clear, step-by-step approach, complete with a template, to challenge collectors, creditors, and credit bureaus. Let’s take control of your debt situation—starting now.

Quick Navigation

- Understanding Debt in Collections

- How to Dispute a Debt in Collections

- Debt Validation Letter Template

- Common Mistakes to Avoid

- What Happens After a Successful Dispute

- Your Next Move

- Frequently Asked Questions

Understanding Debt in Collections

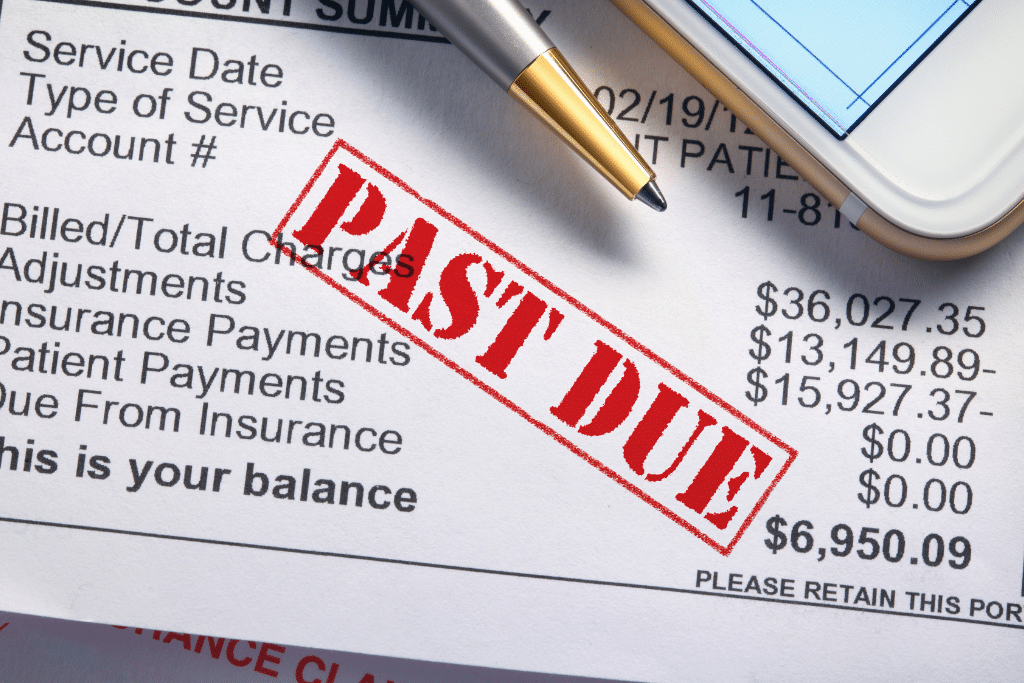

Before diving into the dispute process, it’s essential to know what you’re dealing with. A debt in collections occurs when an original creditor—say, a credit card issuer or medical provider—hands your unpaid balance to a collection agency after missed payments, typically 90-180 days past due. The agency then tries to recover the amount, often adding fees and reporting it to credit bureaus. Typically you may receive a collection notice in the mail, here’s some tips on how to respond.

You have rights under the Fair Debt Collection Practices Act (FDCPA), a federal law that shields you from unfair tactics like threats or excessive calls. Crucially, it also lets you demand proof that the debt is yours and accurate. Errors are common—about 25% of consumers spot mistakes in collections accounts, according to the Consumer Financial Protection Bureau (CFPB). That could mean a debt you’ve already paid, a misreported amount, or one past the statute of limitations (typically 3-7 years, depending on your state). Acting quickly is key—disputes carry the most weight within 30 days of the first notice. Knowing this sets the stage for an effective challenge.

Request Your Free Consultation

How to Dispute a Debt in Collections

Disputing a debt isn’t guesswork—it’s a methodical process. Follow these steps to protect your rights and resolve inaccuracies with confidence.

Step 1: Request Debt Validation

Within 30 days of the initial collection notice, send a written validation letter to the agency. Under the FDCPA, they must prove the debt’s legitimacy—your name, the exact amount, and their right to collect. Use certified mail with a return receipt for proof of delivery. Below is a simple template:

Debt Validation Letter Template

[Your Name]

[Your Address]

[Date]

[Collection Agency Name]

[Agency Address]

Subject: Debt Validation Request for Account #[Insert Number]

Dear [Agency],

I received your notice regarding the above account. Under the FDCPA, I request full validation of this debt, including the original creditor’s name, the amount owed, and proof of your authority to collect. Please send this in writing within 30 days. Until validated, cease all collection efforts.

Sincerely,

[Your Name]

Step 2: Review the Response

The collector has 30 days to reply with documentation—contracts, statements, or creditor records. Check for errors: Is the amount correct? Is the debt too old to enforce (past your state’s statute of limitations)? If they don’t respond, they’re legally barred from collecting until they do. Keep their reply—or lack of it—as evidence.

Step 3: Dispute with Credit Bureaus

If the debt appears on your credit report and the collector’s response is faulty (or absent), file a dispute with Equifax, Experian, and TransUnion. Use their online portals, attaching your validation letter and any supporting docs (e.g., payment records). Be specific—say, “This $2,000 debt is inaccurate; the collector failed to validate it.” Bureaus must investigate within 30-45 days.

Step 4: Follow Up with the Original Creditor

If the collector’s info doesn’t match reality, contact the original creditor (e.g., the credit card company). Send a written dispute detailing the issue—e.g., “This $1,500 debt was paid in full on [date].” Creditors must correct errors reported to agencies or bureaus, adding another layer of resolution.

Step 5: Monitor and Escalate

Track bureau responses—expect updates in 30-45 days. If the debt’s still listed incorrectly, file a complaint with the CFPB at consumerfinance.gov. Collectors ignoring validation requests or harassing you also warrant a CFPB report—it’s a powerful enforcement tool.

Pro Tip: Document everything—letters, receipts, responses.

Common Mistakes to Avoid

Even with a clear plan, missteps can derail your dispute. Here’s what to watch out for.

- Ignoring the Notice: Letting it sit weakens your leverage—those first 30 days are critical for validation rights. Respond promptly to keep the upper hand.

- Paying Without Validation: Sending money before proof waives your right to dispute. Always verify first—paying a $500 error you don’t owe is money lost.

- Relying on Phone Calls: Verbal complaints don’t hold weight legally. Written disputes—via mail or online forms—create a paper trail collectors and bureaus can’t ignore.

Money Fit’s free counseling can spot these pitfalls early. A quick consultation might reveal errors—like a debt past its statute—that save you time and stress. Set reminders for deadlines (e.g., 30 days post-notice) to stay on track.

What Happens After a Successful Dispute

Winning a dispute brings tangible relief—here’s what to expect.

If the collector can’t validate the debt, they must stop all collection efforts, and it’s removed from your credit report if listed. A bureau dispute, if upheld, wipes it from your file within 30-45 days, potentially lifting your credit score. If the amount or terms were wrong, they’re corrected—say, a $3,000 debt drops to $1,000 after proof of payments. One Money Fit client disputed a $5,000 collections error with a single letter, erasing it entirely after the agency failed to respond.

Even if the debt’s valid, you’re not stuck. Money Fit’s debt management plans (DMPs) can consolidate it into one affordable payment, cutting interest and stress. Either way, disputing clarifies your next move—freedom starts with knowing what’s real.

Your Next Move

Disputing a debt in collections is your right—and it’s simpler than it seems. Request validation, review the proof, challenge bureaus and creditors, and monitor results—with a template in hand, you’re equipped to act. Errors get fixed, harassment stops, and you regain control.

You have options beyond disputes. Need help navigating collections or managing valid debts? Money Fit’s nonprofit credit counseling offers free consultations—expertise to turn financial strain into stability. Take that step today.

Request Your Free Consultation

Frequently Asked Questions About Disputing a Debt in Collections

How long do I have to dispute a debt in collections?

You have 30 days from the first collection notice to request validation. After that, you can still dispute, but collectors aren’t required to pause efforts.

What if the debt collector doesn’t respond to my dispute?

If they don’t validate the debt within 30 days, they must stop collection attempts until they do. File a CFPB complaint if they persist without proof.

Can I dispute a debt directly with the credit bureaus?

Yes, if it’s on your credit report, dispute online with Equifax, Experian, and TransUnion. Include your validation letter and any evidence for faster resolution.