Immune to Bankruptcy? Think Again!

These Historical Icons and Celebrities Prove Bankruptcy Can Happen to Anyone

Correction Notice:

CORRECTION (February 12th, 2025): A previous version of this article

erroneously included actor Nicolas Cage among celebrities who had filed for bankruptcy.

Mr. Cage has never declared bankruptcy. We have removed any reference to Mr. Cage from

this article. We apologize for the error.

Nobody wants to admit when they are low on cash and high on debt. Nonetheless, many are

left with no other choice.

If you dread the idea of filling out a few B-309 forms, perhaps some perspective can

help soften the blow. History is laden with famous bankruptcy filers. While they all

have celeb status or historical notoriety, they have one thing in common: they all rode

the tailwinds of their financial success only to find misfortune at some point in

their careers.

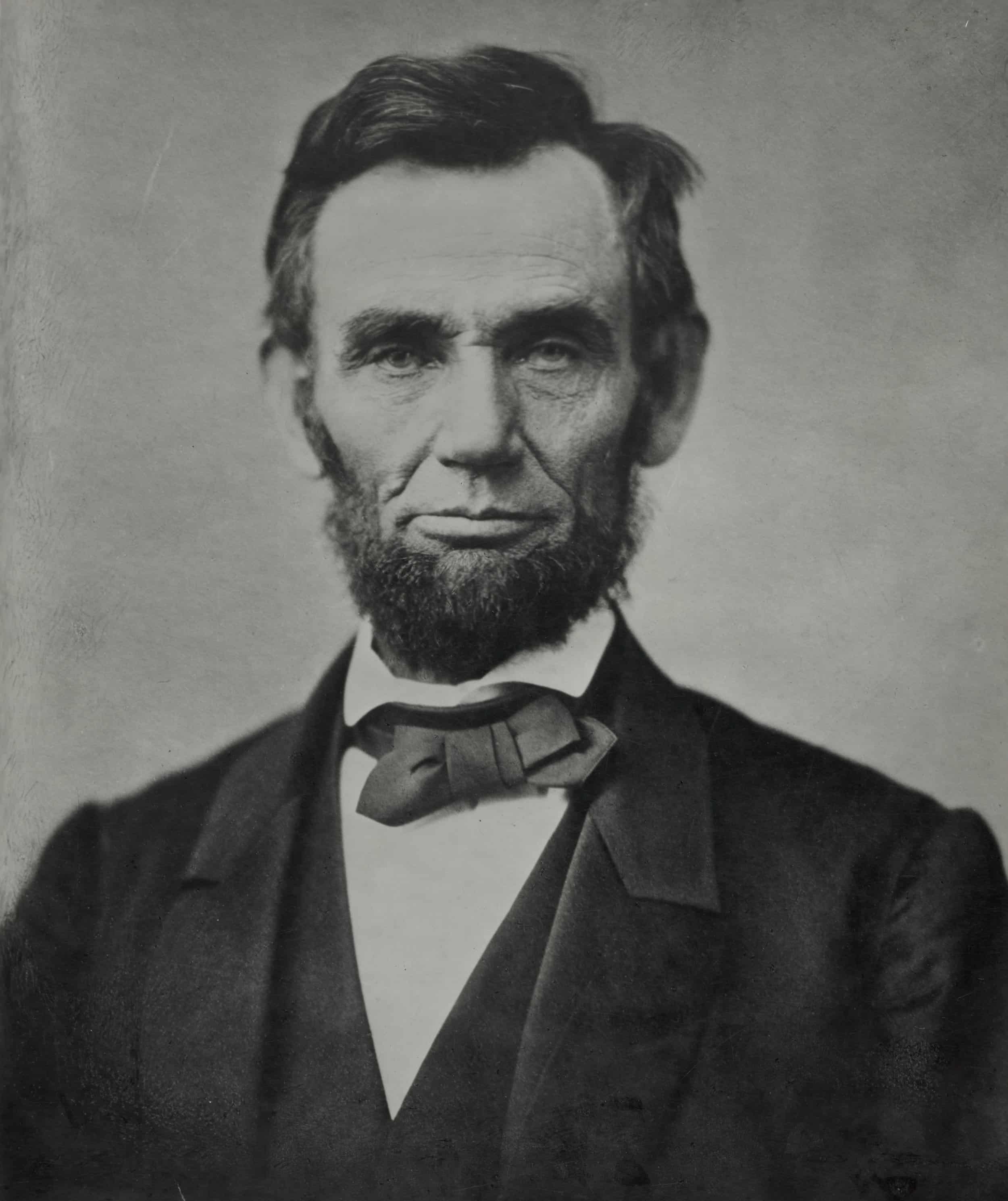

1. Abraham Lincoln

Believe it or not, the president who led the country through the Civil War also had to

declare bankruptcy at one point in his life.

Before he took office in 1861, Abraham Lincoln was a business owner and investor. In the

book, The President and the Freedom Fighter by Brian Kilmeade, we learn that

Lincoln was in his early 20s when he ran a small general store in Illinois around 1833.

Noticing that the business was on a downward spiral financially, he opted to sell 50%

of it. A willing investor bought half the business—only to pass away—leaving future

president Lincoln responsible for 100% of the liabilities.

In the late 1800s, bankruptcy laws were not as developed and “friendly” as they are

today. Lincoln ended up in court with creditors and had his home and other assets

seized. Although he eventually managed to pay his creditors back, Lincoln’s experience

with bankruptcy is a stark reminder that financial trouble can happen to anyone—even a

future president.

2. MC Hammer

“Can’t touch this!” … is probably what MC Hammer told himself when he looked at the

remaining $13 million of his fortune before he filed for bankruptcy in 1996. At the

height of his music career, MC Hammer was reported to have amassed more than $30

million, according to

The Telegraph.

This might sound like a lot. However, as another famous musical adage goes: “Easy come, easy go.”

During the early 90s, MC Hammer went on a lavish three-year spending spree that put him

in deep debt. While his music remained popular, album sales alone were not enough to

sustain his lifestyle. By 1996, he was in debt by $13 million. The predicament forced

him to sell everything he owned—including a home he had spent millions renovating.

These days, he has grown wiser about his finances. He became a minister and even

consulted for startups—proof that nobody is “2 Legit 2 Quit” having money troubles or

learning from them.

3. Walt Disney

Everyone knows Walt Disney as one of the pioneers of animated movies. What most don’t

discuss are the struggles he went through before his rise to success.

Before 1922, Walt Disney ran a small animation studio in Kansas called Laugh-O-Gram.

According to Forbes, Laugh-O-Gram was poised for success, garnering interest

from major companies looking for animated ads.

Unfortunately, Walt Disney was cheated by one of his distributors and did not bring in

enough revenue to keep Laugh-O-Gram afloat. In 1923, he had to declare bankruptcy,

ending what seemed like a promising start in animation.

It took borrowing money from family and friends to get back on his feet. Soon after,

Disney produced Snow White—the first full-length animated film in

history—followed by other iconic works like Mary Poppins and

Cinderella. His story is a testament that while bankruptcy is a stumbling

block, it doesn’t have to be the end of the road.

4. Mike Tyson

Mike Tyson’s boxing career was lucrative enough to earn him millions of dollars in a

single night. The money came from multiple sources: pay-per-view revenue, ticket sales,

merchandise, and TV appearances.

That fortune, however, quickly fueled lavish spending. Tyson’s purchases included

mansions, limousines, designer clothes, and exotic animals. Add in alimony, divorce

settlements, and debt to the IRS, and it’s not hard to see how his finances unraveled.

Despite amassing roughly $400 million over his career, Tyson found himself deeply in

debt. According to The New York Times, he had to file for bankruptcy in 2003.

The heavyweight champion’s experience highlights how easily even massive earnings can

disappear without prudent money management.

5. Gary Busey

Time Magazine notes Gary Busey as one of the most iconic American actors in

Hollywood. With a string of high-grossing films under his belt, he also inherited a

trait ubiquitous among some Hollywood elites—poor money-handling skills.

In February 2012, Gary Busey declared Chapter 7 bankruptcy—meaning his available assets

could not cover his debts. By that time, reports suggest he had about $50,000 to his

name while owing roughly $1 million to various creditors, including the UCLA Medical

Facility, Wells Fargo, and the IRS.

It remains unclear how exactly he ran up his debts, but what is certain is that his

income was not enough to keep up with his financial obligations.

6. Meatloaf

Meatloaf’s bankruptcy filing made headlines in 1983, and it resulted from more than

just overspending. A major lawsuit involving his songwriter, Jim Steinman, served as a

tipping point. Steinman sued Meatloaf for around $80 million, alleging breaches of

music rights laws.

Between 1982 and 1984, Meatloaf’s troubles were compounded when he lost his voice and

was later diagnosed with cocaine addiction and major depression.

His story is a stark reminder that financial distress can be tied to legal battles,

health issues, or both. He eventually recovered and continued performing, proving that

bankruptcy can be a bump in the road rather than the end of a career.

7. Donald Trump

Donald Trump is a billionaire tycoon, was the 45th president of the United States and is the 47th, and

became famous for two words in “The Apprentice.”

Unlike most individuals on this list, Donald Trump has never personally declared

bankruptcy. However, several of his businesses have filed for Chapter 11 bankruptcy.

The first case involved the Trump Taj Mahal in 1991. Over the following decade, he

sought bankruptcy protection multiple times for various casino and entertainment

ventures.

For many, these filings raise eyebrows. However, the key lesson for everyday consumers

is the distinction between business bankruptcy and

personal bankruptcy—a critical consideration when forming and funding

business ventures.

8. Burt Reynolds

The late Burt Reynolds experienced the pinnacle of success during the 70s and 80s as a

top Hollywood draw. But like many celebrities, he spent his fortune faster than he

could earn it.

He splurged on real estate (his property “Valhalla”), sports cars, horses, and a

lifestyle fit for a star. The high life caught up with him in 1993, when a costly

divorce settlement with Loni Anderson dealt a significant blow to his finances.

By 1996, Reynolds had amassed around $10 million in debt and was forced to file for

bankruptcy. In interviews, he admitted that he’d never been particularly “smart about

money,” underscoring how even high earners need financial discipline to maintain their

wealth.

9. Dave Ramsey

Dave Ramsey is one of America’s most recognized voices on personal finance, known for

his radio show and financial coaching. However, he learned many of his lessons the hard

way—by declaring bankruptcy.

Early in his real estate career, Ramsey leveraged huge loans without establishing

reliable income streams. Although he made millions in his mid-20s, the banks called his

debts due when the market shifted. By 1988, he declared bankruptcy.

Today, his net worth exceeds $200 million, according to Investopedia. Through

Ramsey Solutions, he helps others avoid the same debt pitfalls he once faced, proving

that financial disaster can be the first chapter of a bigger comeback story.

Wrapping Up

Bankruptcy can happen to just about anyone, regardless of fame, fortune, or historical

significance. Nearly all of the individuals on this list struggled with money

management, whether it was reckless spending, unexpected legal troubles, or major life

changes.

One crucial takeaway is that there is indeed life after bankruptcy.

While filing shouldn’t be your first plan, it doesn’t mean you can’t recover. Many of

the notable names above bounced back stronger—often armed with a much healthier

understanding of their finances.

Final Note

Again, we acknowledge an earlier error in including Nicolas Cage in this article;

he has never filed for bankruptcy. The information above focuses

solely on individuals who actually did seek bankruptcy protection at some point in

their lives, whether personal or for business needs.

Disclaimer: This revised article is intended for educational

purposes and should not be taken as legal or financial advice. If you have questions

specific to your situation, consult an attorney or a qualified financial professional.