Drowning in Debt? You’re not alone. There is hope.

Drowning in debt can be an overwhelming and stressful experience. It can feel like you’re constantly struggling to keep your head above water, with no relief in sight. Debt can come in many forms, from credit card balances to student loans to mortgages, and the pressure to make payments on time can feel suffocating. In fact, the hidden costs of debt are staggering as it can take a toll on your mental and physical health and missed opportunities.

One of the first steps in tackling debt is to create a comprehensive list of all your outstanding balances, including the interest rates and minimum monthly payments. This will help you get a clear picture of your financial situation and allow you to prioritize which debts to pay off first. You may also want to consider reaching out to your creditors to negotiate more favorable terms, such as a lower interest rate or a payment plan that works better for your budget.

In addition to reducing your debt, it’s also important to avoid taking on new debt in the future. This may mean reevaluating your spending habits, creating a budget to help you stay on track, and developing a plan for building up an emergency fund so that unexpected expenses don’t throw you off course.

If you’ve found yourself in a less-than-ideal financial situation, it can feel like an endless cycle of trying to play catch-up. And even still, catching up can be nearly impossible when you’re barely able to make ends meet—that’s probably how you ended up here in the first place.

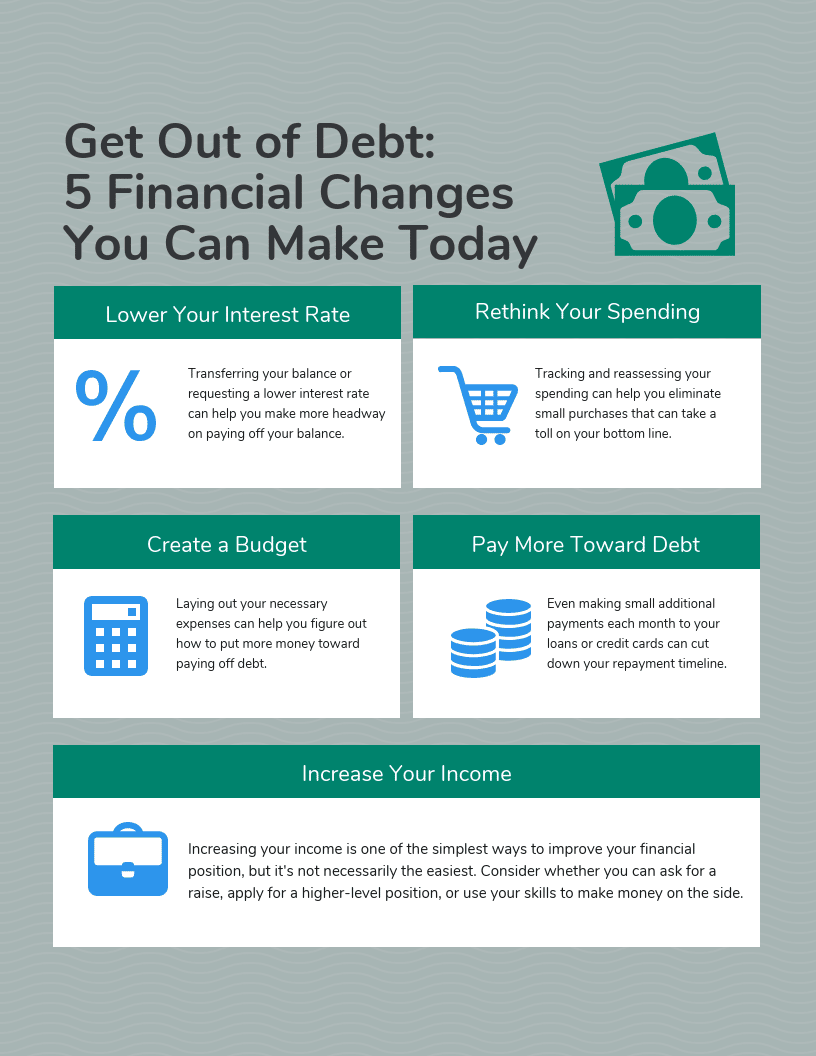

No matter how hopeless your debt situation may seem, taking the right steps can help you work toward financial freedom, even if it’s still a long way off. Here are 5 financial changes you can make today to help you work toward getting out of debt.

5 Financial Changes You Can Make Today

1. Try to Get a Lower Interest Rate

One of the first things you should do is look into whether you can qualify for a lower interest rate. You may be able to transfer your credit card debt balance to one that has a lower interest rate. Or, you may be able to qualify for a loan with a lower interest rate than your current cards, allowing you to pay off several sources of debt. According to NerdWallet, the average APR for credit cards in the last quarter of 2019 was 16.97%—that’s pretty high. However, you might be able to stop paying this high-interest rate if you can qualify for a card with a 0% introductory APR*. Usually, these rates only last for 12 to 18 months, but that’s a lot of time to allocate that money you’re saving on paying interest toward paying off your balance instead.

Even though you’re not automatically reducing the amount of debt you currently owe, you will be able to slow down how much more you accumulate.

2. Rethink Your Spending Habits

Developing healthier money habits is essential to making real progress toward a debt-free lifestyle.

If the reason you’re in debt is due to your spending habits, it’s time to nip it in the bud. While this might seem easier said than done, there are ways to at least reduce some of your spending on non-necessities.

Tracking your spending is the first step in moving toward better money habits. You need to understand what you’re spending, why you’re spending, and how much you’re spending on each category. Over the course of a month or two, track everything you spend. This will give you a good idea of your regular purchases and help rule out one-offs (like paying your car registration) that might make one month much more expensive than another. Once you identify areas where you’re excessively spending and you don’t need to be, it will be a good basis for creating a

a realistic budget that you can stick to.

3. Create a Budget (And Stick to It)

Making a budget might seem complicated, but it doesn’t have to be. Creating a budget is actually fairly easy if you keep it simple by using a spreadsheet that just lays out which expenses you have and how much they cost. Otherwise, you can even use a handy app to make your budget for you.

Create a budget that lays out all your recurring monthly expenses.

This will give you a good overview of what expenses you actually need to use the income for while eliminating those you don’t. Of course, you’re not expected to cut out all your fun expenses. However, you will likely have to make some pretty significant changes if you truly want to make a dent in the debt you owe.

Once you’ve developed a more practical approach to how you spend your money each month, you have to put your plan into action.

Stick to your budget.

While it might seem obvious that you want to make an effort to stick to your budget, many people take the time to create a budget and then never look at it again. In order to change how you spend, you need to put your budget into practice, meaning staying within the spending limits you’ve designated for each category.

While it might be hard to get used to reducing your spending, it’s an important change to make if you’re looking to get out of debt as soon as possible.

4. Allocate More Money to Paying off Debt

Once you’ve identified your problem spending habits and made adjustments to where your money’s going, you can allocate that new wiggle room in your budget toward paying off your debt. Even though an extra $50 a month towards your credit card doesn’t seem like much, it can make a big impact over the course of a year, especially when it comes to battling increases in your balance due to interest.

If you have multiple sources of debt, you’ll likely want to come up with a plan as to how you’re going to divvy up this newly available money to pay them off. How you choose to pay off your debt depends on your priorities. Here are two popular options for using extra money to pay off your debt:

-

Preventing high-interest accrual: If you’re most concerned with limiting how much interest you’re paying, you’ll want to tackle the card with the highest interest rate first.

-

Eliminating the smallest balance first: If you’re the kind of person who gets satisfaction from checking off items on a list, you will probably want to start with the lowest balance first. This way, you can feel that sense of satisfaction when you are able to take that debt account off your plate.

Whichever of these focused payment methods you choose to use, keep in mind that you still need to be making your minimum payments on your other cards or loans (but that should already be configured into your budget).

5. Focus on Ways You Can Increase Your Income

To truly take on your debt and get yourself out for good, you’ll need to increase your income so that you no longer have to rely on other payment methods. And, by making more money, you’ll be able to chip away at your debt faster. Just make sure you don’t use this new source of income to further fuel your spending habits.

This might sound easier said than done, but there are actually several ways you can go about increasing your income:

-

Asking for a raise

-

Freelancing

-

Taking on a second job

-

Investing some of your savings

Depending on the type of work you do, you could substantially increase your income without even having to leave your house. While increasing your income might not be a simple undertaking, it’s one of the only ways to significantly change your financial situation.

Remember, tackling debt is a marathon, not a sprint. It may take time and effort to see progress, but every step you take toward becoming debt-free is a step in the right direction. Don’t be discouraged by setbacks or challenges along the way, and don’t hesitate to seek out professional help if you need it. With dedication and persistence, you can overcome your debt and achieve financial freedom.