Credit Card Debt Relief

Your Guide to a Debt-Free Life with Nonprofit Counseling

Credit cards are everywhere—over 80% of Americans have at least one—but for many, they’re a fast track to financial stress. If you’re feeling trapped by credit card debt, you’re not alone. This guide reveals the causes, effects, and practical solutions to reclaim your financial freedom. At Money Fit, a nonprofit credit counseling service founded in 1996, we’ve spent nearly 30 years helping people conquer unsecured debt, with a special focus on the unique challenges of credit cards. Start with a free consultation and let’s build your path to a debt-free life.

Key Topics to Understand Credit Card Debt

Credit card debt doesn’t happen in a vacuum—it’s often driven by common challenges that millions face. Explore these key topics to understand why debt builds, how it impacts your life, and what you can do about it. Each guide offers practical insights and solutions to help you take control, backed by Money Fit’s nearly 30 years of nonprofit credit counseling expertise.

Living Beyond Means

Spending more than you earn is a common trap that fuels credit card debt. Learn how to spot overspending habits, create a budget that works, and break the cycle for good.

Read: How to Stop Living Beyond Your Means

Unexpected Medical Bills

A single medical emergency can lead to thousands in credit card debt—even with insurance. Discover strategies to manage medical bills and protect your finances from unexpected costs.

Read: Managing Unexpected Medical Bills

Being Unprepared to Use or Own Credit Cards

Not understanding credit cards can lead to costly mistakes. Get the knowledge you need to use credit wisely and avoid debt with our expert-backed tips for first-time users.

Read: Tips for First-Time Credit Card Users

The Emotional Toll

Debt isn’t just a number; it’s a heavy burden that can lead to anxiety, stress, and even depression. At Money Fit, we’ve seen how financial pressure can strain relationships and rob you of peace—but our nonprofit counselors are here to help you find relief.

Learn More: The Psychology of Credit Card Debt

The Financial Fallout

Long-term credit card debt can trap you in a cycle of reduced savings and missed opportunities. It can make investing for the future feel impossible and, in extreme cases, lead to bankruptcy. Don’t let debt derail your dreams—our experts can guide you to a better path.

Learn More: The Risks of Too Much Credit Card Debt

The Credit Score Hit

Carrying a high balance or missing payments can tank your credit score, making it harder to secure loans, mortgages, or even a rental apartment. A damaged score can haunt you for years, but Money Fit’s counseling can help you rebuild and recover.

Learn More: Tips to Improve Your Credit Score

Create a Budget That Works

Take control by knowing where your money goes. Track every expense, cut unnecessary spending, and funnel the savings toward your debt. Money Fit’s free budgeting tools can make this easier than ever.

Learn More: How to Budget Effectively

Enroll in a Debt Management Plan (DMP)

Overwhelmed by multiple cards? A DMP combines your debts into one affordable payment, often with lower interest rates—without a loan. As a nonprofit, Money Fit negotiates with creditors to lighten your load and get you debt-free faster. Curious about other debt consolidation options?

Learn More: Understanding Debt Consolidation

Get Expert Nonprofit Counseling

Don’t go it alone. Our counselors at Money Fit provide personalized plans to tackle credit card debt, drawing on nearly 30 years of helping people just like you. Start with a free consultation and build a roadmap to financial freedom.

Learn More: Benefits of Credit Counseling

Real-life Examples of Overcoming Debt

See how others have conquered credit card debt with Money Fit’s help. These inspiring stories show what’s possible when you take control of your finances.

Learn More: Success Stories

The Money Fit Difference

Discover why Money Fit stands out as a nonprofit credit counseling service, with nearly 30 years of helping people achieve financial freedom.

Learn More: Why Choose Money Fit

Common Questions About Credit Card Debt

Get answers to the most frequently asked questions about credit card debt, from how interest works to why professional help can make a difference.

Learn More: Frequently Asked Questions

Credit Card Debt Consolidation FAQs

Dive deeper into managing credit card debt with answers to common questions about debt consolidation, including how a Debt Management Plan can help.

Learn More: Debt Consolidation FAQs

Money Fit’s Financial Tools

Use our free calculators and tools to plan your budget, estimate debt payments, and take control of your finances.

Learn More: Budgeting and Debt Calculators

Government Resources for Debt Relief

The Consumer Financial Protection Bureau (CFPB) offers tools and information on debt relief, consumer rights, and avoiding scams.

Learn More: CFPB Debt Resources

Nonprofit Support from NFCC and FCAA

The NFCC and the FCAA provide resources and referrals to certified counseling agencies like Money Fit, a member of both organizations.

Learn More: NFCC Support | FCAA Advocacy

Understanding Credit Card Debt: Causes, Effects, and Solutions

Credit cards can be a helpful tool, but they often lead to debt that’s hard to escape. At Money Fit, we’ve spent nearly 30 years helping people understand and overcome this challenge. Let’s explore how credit card debt starts, grows, and impacts your life, so you can take the first steps toward financial freedom.

The Rise of Credit Card Usage

Credit cards have become a staple in modern life, offering unmatched convenience, rewards programs, and the ability to make big purchases without immediate payment. But this ease comes with a significant downside: it’s simpler than ever to accumulate debt. Many households now carry substantial credit card balances, driven by a culture of instant gratification, aggressive marketing, and economic pressures that make saving harder. The Federal Reserve notes that credit card usage has surged over the decades, reflecting a shift in spending habits. This widespread reliance often leads to overextension, where small purchases add up, and balances grow unchecked, setting the stage for financial strain that can last for years if not addressed early.

The Cycle of Borrowing

Every credit card swipe is a loan, and if you don’t pay the full balance by the due date, interest kicks in—often at rates exceeding 20%. This interest compounds daily, meaning your debt grows faster than you might expect. Minimum payments, which are typically low, barely cover the interest, leaving the principal untouched. Add new purchases to the mix, and you’re trapped in a cycle of borrowing that’s hard to escape. Many people find themselves on this treadmill, making payments that never seem to reduce the balance. At Money Fit, we’ve seen how this cycle can feel endless, draining your finances and peace of mind. But with the right strategies, you can break free. Understanding how this cycle works is the first step to stopping it, and our nonprofit counselors are here to help you create a plan that works for your unique situation, paving the way to a debt-free future.

The Hidden Costs of Debt

Credit card debt isn’t just a financial burden—it takes a toll on every aspect of your life. The stress of mounting balances can lead to anxiety, sleepless nights, and even depression, straining your mental health and relationships. High balances can also damage your credit score, making it harder to secure loans, mortgages, or even a rental apartment. A low score often means higher interest rates on future borrowing, creating a ripple effect that impacts your financial stability for years. Beyond the numbers, debt can derail your dreams, forcing you to delay major life goals like buying a home, starting a family, or saving for retirement. At Money Fit, we understand these hidden costs and the emotional weight they carry. Our nonprofit counseling services are designed to address not just the debt, but its broader impact, helping you regain control and rebuild your financial and personal well-being with a clear, supportive plan.

The Path to Financial Freedom

Breaking free from credit card debt starts with understanding its causes and effects, but it doesn’t stop there. A clear path forward involves practical strategies like creating a budget, tracking expenses, and exploring debt management plans that consolidate payments without loans. Nonprofit counseling can make a difference by offering tailored advice, negotiating with creditors to lower interest rates, and providing a roadmap to financial freedom. At Money Fit, we’ve guided thousands through this journey over nearly 30 years, helping them regain control and rebuild their lives. Education is key—learning how to use credit wisely prevents future debt. Support from trusted experts ensures you’re not alone in the process. Whether you’re just starting to tackle your debt or looking for advanced strategies, our team is here to help. Take the first step today and discover how a structured plan can lead you to a debt-free future with confidence and clarity.

Ready to Take Control of Your Debt?

Don’t let credit card debt weigh you down. It’s time to take control and chart a path to financial freedom. Our team at Money Fit is here to guide and support you every step of the way. Call us at 1-800-432-0310 or apply online to start your journey toward a debt-free life.

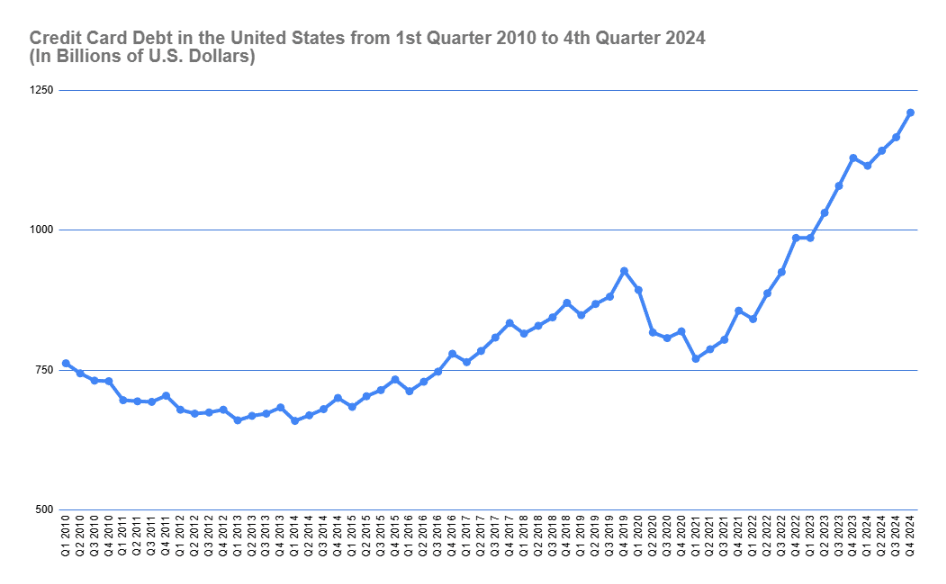

You Are Not Alone: Credit Card Debt in the United States Tops $1.2 Trillion

Success Stories:

Triumph Over Credit Card Debt

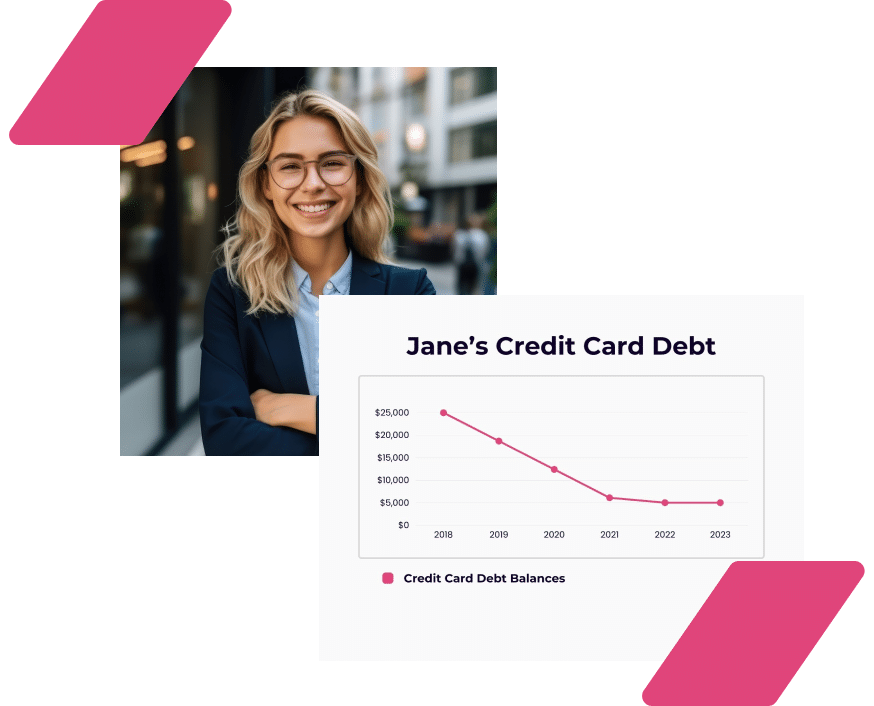

Jane's Journey: From Overwhelming Debt to Financial Freedom

Before: Jane, a 32-year-old marketing professional, found herself buried under $25,000 in credit card debt. A combination of unexpected medical bills, impulsive shopping, and not being financially literate played a significant role in her growing debt.

The Turning Point: Jane reached out to Money Fit, seeking guidance on managing her spiraling finances. Our team helped her with budgeting, expense tracking, and introduced her to the concept of debt avalanche to tackle her highest interest rates first.

Outcome: Within two years, Jane managed to clear 80% of her debt. Today, she’s not only debt-free but also champions financial literacy in her community, ensuring others don’t fall into the same traps she did.

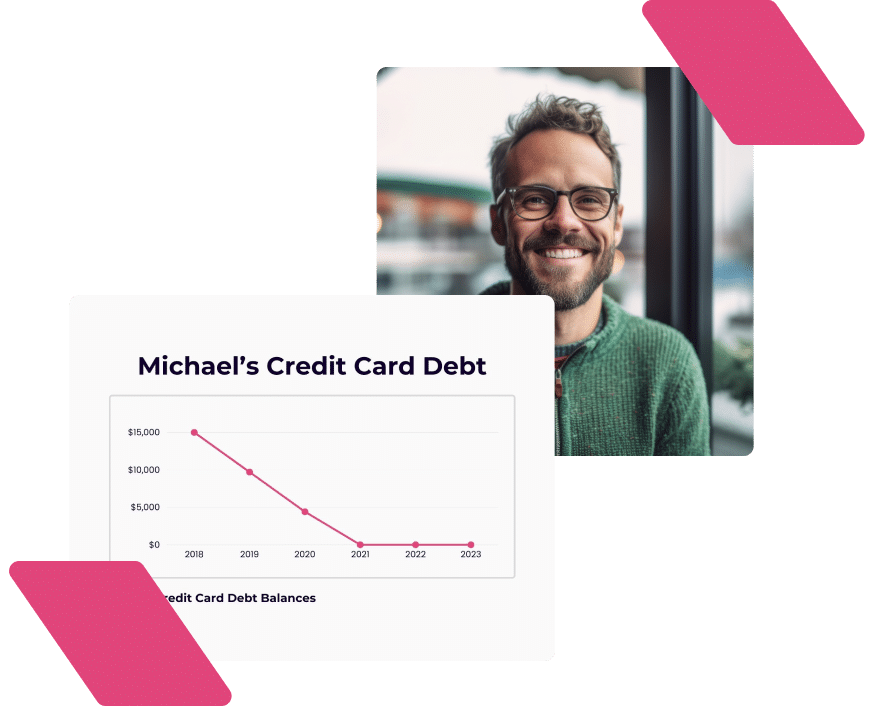

Michael's Momentum: Breaking the Chains of Minimum Payments

Before: Michael, a single father of two, was making only the minimum payments on his three credit cards, believing he was managing his debt. However, the accruing interest meant he was barely making a dent in the principal amount, totaling $15,000.

The Turning Point: After attending a Money Fit workshop, Michael realized the pitfalls of minimum payments. He decided to consolidate his debts and worked with our counselors to develop a tailor-made repayment plan.

Outcome: In 34 months, Michael was free of credit card debt. The money he previously used for repayments is now being invested in his children’s education funds.

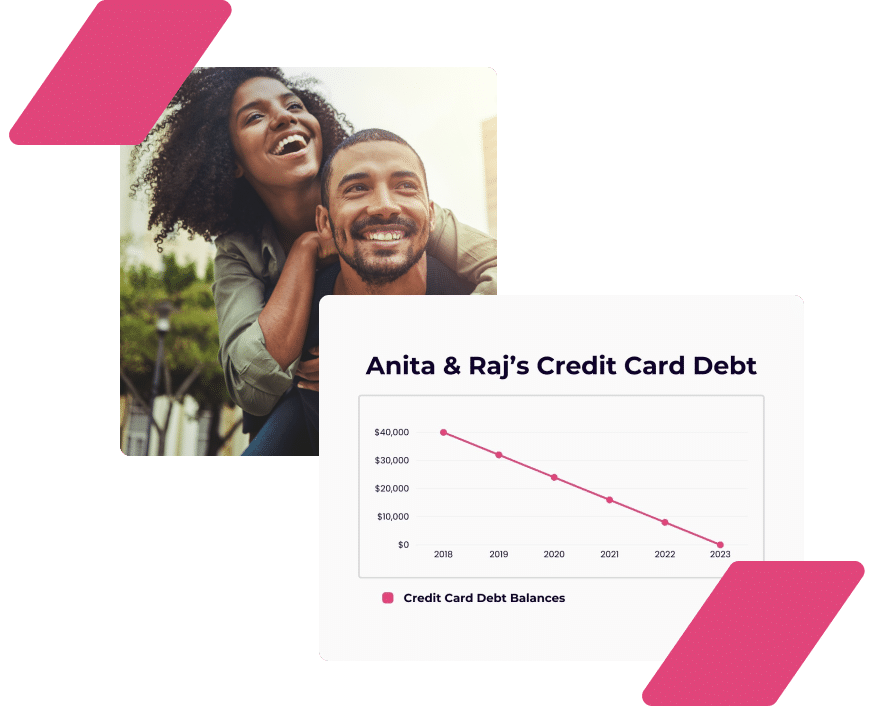

Anita and Raj: A Couple's Collective Effort to Ditch Debt

Before: Anita and Raj, newlyweds in their late twenties, started their married life with a combined credit card debt of $40,000. The stress began affecting their relationship, with constant arguments about money.

The Turning Point: The couple approached Money Fit for joint counseling. They learned about the benefits of a debt management plan, and how Money Fit would work with their creditors to reduce their monthly payments, lower their interest rates, and have them out of debt in 5 years or less.

Outcome: Today, Anita and Raj are not only debt-free but also have a healthy emergency fund and savings for their future home. Their journey with Money Fit not only improved their finances but also strengthened their bond as a couple.

The stories presented on this page are fictional and are intended for illustrative purposes only. While they are representative of real experiences and results, they are generalized to protect identities of actual Money Fit clients. If you find yourself relating to any of these tales, remember that it’s never too late to seek help and rewrite your financial story.

These success stories embody the transformative power of informed financial decisions and the pivotal role Money Fit plays in facilitating them. If you find yourself relating to any of these tales, remember that it’s never too late to seek help and rewrite your financial story.

Frequently Asked Questions: Your Credit Card Questions Answered

Credit card debt can feel overwhelming, but understanding it is the first step to overcoming it. Here are answers to the most common questions we hear at Money Fit, a nonprofit credit counseling service with nearly 30 years of experience helping people like you.

The amount varies, but millions of Americans carry thousands in credit card debt—a clear sign it’s a widespread challenge. At Money Fit, we’ve seen how this burden affects families, and we’re here to help you tackle it with effective strategies.

Credit card interest, often over 20%, compounds daily on unpaid balances. Minimum payments mostly cover interest, leaving the principal untouched. This cycle causes your balance to grow despite payments. Our counselors can help you stop this spiral with a tailored plan.

The snowball method pays off smaller debts first for quick wins, while the avalanche method targets high-interest debts to save on interest. Both work, depending on your needs—quick progress or long-term savings. We can help you choose the best approach for your situation.

Yes, many companies will negotiate, especially if you’re facing hardship. You might secure a lower rate or a settlement, but it’s tricky. Money Fit’s nonprofit experts can negotiate on your behalf, reducing rates and stress while helping you pay off debt faster.

High balances increase your credit utilization, hurting your score. Late or missed payments also get reported to credit bureaus, lowering your rating further. A damaged score can limit your options, but our counseling can guide you to repair and rebuild it over time.

Yes, especially with a nonprofit like Money Fit. Our counselors offer personalized plans, creditor negotiations, and financial education to help you manage debt effectively. With nearly 30 years of experience, we’ve helped thousands achieve financial freedom—call us at 1-800-432-0310 to start.

Have more questions?

Don’t hesitate to contact us directly or explore our extensive resource library for deeper insights into credit card debt.

Resources to Help Manage Credit Card Debt

While our comprehensive guide offers a broad overview of credit card debt, there’s always more to learn. To further empower you in your journey towards financial literacy and freedom, we’ve curated a list of valuable resources, from detailed articles to tools that can help you gain deeper insights and make informed decisions.

Articles & Guides

- The Science Behind Credit Card Interest: Learn about the complexities of how interest is calculated and how it impacts your overall balance. Read More →

- The Emotional Toll of Debt: Understanding the psychological implications of long-standing credit card debt. Read More →

- A Comprehensive Guide to Debt Consolidation: Explore the pros and cons of merging multiple debts into one. Read More →

Tools & Calculators

- Debt Management Calculator: Calculate your estimated monthly payment through a Debt Management Program. Try it out →

- Credit Card Debt Calculator: Quickly estimate the required payments on your credit cards based on their balances. Try it out →

- 50/30/20 Budget Rule Calculator: This calculator offers a practical and efficient method to take when financial planning. Try it out →

Free Personal Finance Courses

- Credit Voyage & Savings Success: Created in partnership with the Capital One Impact Initiative, these courses are designed to help you change your behavior and achieve financial success.

- A Credit to You: Credit Basics: This course helps you understand what you need to know about credit histories, credit reports, and credit scores. Learn More & Sign Up →

Books & Literature

- “Everyday Money for Everyday People” by Todd Christensen: Unlock financial stability and success with ‘Everyday Money for Everyday People’ – your gateway to breaking free from the paycheck-to-paycheck cycle. Drawing from centuries-old wisdom and modern insights from numerous workshops, Todd Christensen offers actionable tips and inspiring stories to guide you in making savvy, everyday financial decisions. Transform your financial future with a book forged from real experiences and proven strategies.

- “Surviving Debt – 2025 Edition” by the National Consumer Law Center: Navigate your way out of debt with the 2025 edition of ‘Surviving Debt’, acclaimed as the ‘best all-around guide’ by Business Insider. For over a quarter-century, this comprehensive resource has empowered millions with hard-hitting, expert advice on tackling various forms of debt. From managing medical and credit card debt to understanding the intricacies of bankruptcy, this edition brings fresh insights on contemporary issues including student loan cancellation and dealing with debts incurred from an abusive partner. Equip yourself with strategies to avoid foreclosure, increase income, and safeguard your financial future, all curated by the nation’s leading consumer law experts.

Personalized Assistance:

Tailored Solutions for Your Unique Financial Situation

While general information and resources are invaluable, there’s no substitute for personalized guidance tailored to your individual circumstances. At MoneyFit.org, we understand the nuances and intricacies that each person’s financial situation brings. Here’s how you can engage with us for a more tailored experience:

One-on-One Credit Counseling

Every financial journey is unique. Whether you’re at the start of your credit card debt journey or looking for advanced strategies to manage existing debt, our expert counselors are here to guide you.

- What to Expect: A detailed analysis of your current financial situation, actionable strategies to manage and reduce your debt, and ongoing support to help you achieve your financial goals.

- Schedule a Session: Ready to take control of your financial future? Book your personalized counseling session now →

Custom Debt Management Plans (DMPs)

For those who require a structured approach to managing multiple debts, our DMPs provide a roadmap to financial freedom.

- What to Expect: Consolidation of multiple credit card payments into a single monthly payment, potential reductions in interest rates, and a clear timeline to becoming debt-free.

- Learn More: Interested in how a DMP can benefit you? Discover the advantages and get started →

Articles About Credit Cards

Equip yourself with essential knowledge about credit cards through our comprehensive articles:

- How Credit Cards Work

- Understand the mechanics and features of credit cards, from interest rates to grace periods.

- Reasons to Own a Credit Card

- Explore the benefits of having a credit card, from building credit to earning rewards.

- Reasons to Avoid Owning a Credit Card

- Discover potential pitfalls and reasons why some choose to live without credit cards.

- How to Get Out of Credit Card Debt

- Learn actionable strategies to reduce and eliminate your credit card debt effectively.

- Credit Card Mistakes to Avoid

- Familiarize yourself with common errors cardholders make and how to steer clear of them.

- Credit Card Debt Consolidation

- Explore the process of consolidating multiple credit card debts into one manageable payment.

Empower yourself with these insights and make informed financial decisions.

Money Fit Community Support

Connect with others on the same journey in our dedicated community forums. Share your experiences, learn from others, and find motivation in a supportive environment.

- Join the Conversation: From success stories to discussions on the latest debt management strategies, there’s a topic for everyone. Engage with the Money Fit community on X → or on Facebook and participate in the conversations.

Ready to Pay Off Your Credit Cards?

Don’t let credit card debt weigh you down. It’s time to take control and chart a path to financial freedom. Our team is here to guide and support you every step of the way. Call us at 1-800-432-0310 or apply online to start your journey towards a debt-free life.