These historical and pop culture figures prove bankruptcy isn’t the end — it’s sometimes the beginning of a new chapter.

Correction Notice:

CORRECTION (February 12th, 2025): A previous version of this article erroneously included actor Nicolas Cage among celebrities who had filed for bankruptcy. Mr. Cage has never declared bankruptcy. We have removed any reference to Mr. Cage from this article. We apologize for the error.

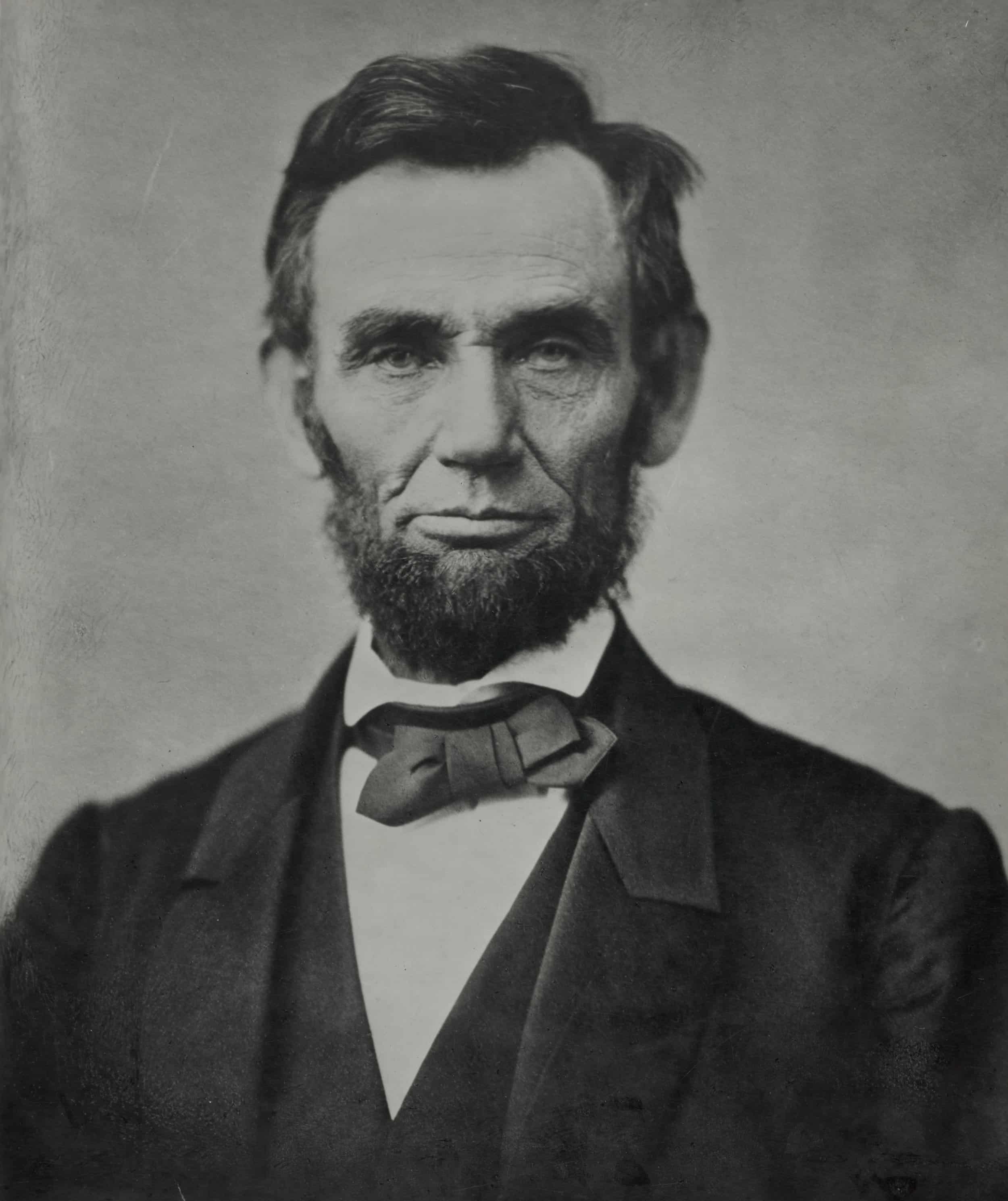

1. Abraham Lincoln

Before he became president, Abraham Lincoln co-owned a struggling general store with a partner in New Salem, Illinois. Unfortunately, the business struggled from the start and eventually failed. When his partner passed away, Lincoln found himself responsible for the full extent of the business’s debts. At the time, bankruptcy laws were limited and harsh — there was no such thing as a fresh start through formal discharge. Instead, Lincoln was pursued by creditors for years. His personal property was seized, including his horse and surveying equipment. He spent nearly two decades repaying the debts through his earnings as a lawyer and public servant. Despite these hardships, Lincoln rose to become one of the most respected figures in American history. His journey from indebted shopkeeper to President of the United States is a powerful example that financial failure does not define a person’s future — it can be the foundation of a legacy built on integrity, perseverance, and public service. His resilience shows that even a future president can face financial ruin.

2. MC Hammer

At his peak, MC Hammer was worth more than $30 million. But his lavish lifestyle outpaced his income. In 1996, facing $13 million in debt, he filed for bankruptcy. He later reinvented himself as a minister and tech consultant — showing that financial comebacks are always possible.

3. Walt Disney

Before the magic kingdom, Walt Disney filed for bankruptcy after his first animation company, Laugh-O-Gram Studios, went under in 1923. He was cheated out of a distribution deal and couldn’t pay his staff. From that failure, he went on to build one of the most recognizable brands in the world.

4. Mike Tyson

Mike Tyson earned more than $400 million during his boxing career — and lost nearly all of it. Lavish purchases, legal fees, and IRS debts led him to file for bankruptcy in 2003. Today, he remains a pop culture icon and example of personal reinvention.

5. Gary Busey

Gary Busey filed for Chapter 7 bankruptcy in 2012, listing debts of over $1 million and assets worth only $50,000. Despite his fame, mounting medical expenses and IRS debt contributed to his financial decline.

6. Meatloaf

In 1983, Meatloaf filed for bankruptcy after being sued by his songwriter for $80 million. Vocal issues and personal struggles added to his challenges. He later returned to music with renewed success.

7. Donald Trump (Business Bankruptcy Only)

While Donald Trump has never filed for personal bankruptcy, several of his business ventures — particularly in the casino and hospitality industries — have sought Chapter 11 bankruptcy protection. These filings occurred between 1991 and 2009 and involved high-profile assets such as the Trump Taj Mahal and Trump Plaza Hotel. Chapter 11 allowed these businesses to restructure their debts and continue operating while renegotiating terms with creditors. Trump’s business bankruptcies have been widely covered in the media, sometimes critically, but they also underscore the role bankruptcy plays in corporate strategy. His example highlights the important distinction between business and personal filings. Like Abraham Lincoln, his experience helps destigmatize bankruptcy overall — especially as he went on to become both the 45th and 47th President of the United States. For many, his story is a reminder that financial challenges, whether personal or professional, do not have to end a career. In some cases, they serve as a stepping stone to even greater success.

8. Burt Reynolds

Hollywood icon Burt Reynolds filed for bankruptcy in 1996 with nearly $10 million in debt. A combination of poor investments, a high-profile divorce, and real estate losses contributed to his financial troubles.

9. Dave Ramsey

Now a leading voice in personal finance, Dave Ramsey filed for bankruptcy in 1988 after a failed real estate venture. He rebuilt his career by helping others learn from his mistakes — proving that recovery is always possible.

Final Thoughts

Bankruptcy can affect anyone — from presidents and athletes to entrepreneurs and entertainers. These stories serve as a reminder that financial setbacks don’t define your future.

There is life after bankruptcy. The most important chapter is the one you write next.

Disclaimer: This article is for educational purposes only and does not constitute legal or financial advice. Please consult a qualified professional for guidance specific to your circumstances. Additionally, this article does not pass judgment on any of the individuals mentioned. Its purpose is to emphasize that bankruptcy is not a moral failing and should not be a source of shame. Many have faced financial hardship — and recovered. You are not alone.

Related Articles

Explore more resources to help you make informed decisions:

Frequently Asked Questions About Famous Bankruptcy Filers

Has Donald Trump personally filed for bankruptcy?

No. Donald Trump has never filed for personal bankruptcy. However, several of his businesses have filed for Chapter 11 reorganization.

Did Abraham Lincoln really go bankrupt?

Yes. Abraham Lincoln was responsible for debts from a failed business in his 20s and had to repay creditors over many years.

What can we learn from famous bankruptcy filers?

That bankruptcy is not the end. Many people — including celebrities and leaders — rebuild stronger afterward.