How to Build Your Credit Rating

When building credit from scratch (as most young adults must) or rebuilding credit after a run of difficult financial challenges (medical, collections, bankruptcy, job loss, etc.), there are several steps to take to improve credit scores and show potential creditors that you are not a high risk to them so that they’ll charge you a lower interest rate.

What would be considered the best way to build or rebuild your credit rating?

Many of the same strategies used to build credit from scratch can also help consumers with poor credit to rebuild their ratings. The process should focus on adding positive, up-to-date credit-related information to the consumer’s credit report while removing inaccurate, negative information.

The fastest way to rebuild your credit score involves disputing and correcting negative, inaccurate information on your credit report that is dragging down your score. Otherwise, adding active and properly maintained credit accounts tends to satisfy credit scoring models that search for reliable information to predict your future credit-related behavior.

Whether you want to build your credit or you need to rebuild it after a rough financial patch, here are six simple and sensible steps you can take to end up with a great credit rating.

-

Pull your credit report and dispute inaccurate, negative information

-

Become an authorized user on a trusted family member’s credit card account

-

Ask your utility company to report your history of payments to the credit reporting agencies

-

Start with a small line of credit from a tire shop or a retail store

-

Find a no-fee secured credit card and use it sparingly

-

Take advantage of a credit-builder loan

The order of these steps is not random. Steps 1 through 3 involve no possibility of fees or interest charges. The further down the list you go, the more work the steps will require of you. Finally, steps 4 through 6 involve the likelihood of additional costs.

Not all steps are available to all consumers. For example, you may not have a trusted family member with good credit who is willing to add you as an authorized user. On the other hand, most consumers live in states where the utility companies do not report – or are not willing to report – payment histories to the consumer reporting agencies (also known as credit bureaus or, below, simply CRAs).

These six steps offer a straightforward and reasonable approach to credit building:

1. Pull Your Free Credit Report

Many online websites offer a “free credit score” and a free credit analysis. Many even say they can provide you with a free credit report. The truth is that most of these “free reports” are only available if you sign up for a monthly subscription service of some sort, often costing from $10 to $50 a month. Consequently, these companies often require you to provide them with a credit or debit card in order to provide you with the so-called free report.

Steer clear!

Only one site is the federally mandated place to get your free credit report per the 2003 Fair and Accurate Credit Transaction Act (or FACT Act): www.AnnualCreditReport.com (also available by phone at 877-322-8228)

Per the FACT Act, all American adults can get a free credit report from each of the three major consumer reporting agencies (Equifax, Experian, and TransUnion) every twelve months. You can pull all three reports at once or get them individually throughout the year.

Your free report will not include your credit score. The FACT Act only provides access to your report. If you want your credit score, you will have to pay for it or actually apply for a loan (and ask your lender for it). The “free scores” you can access online at places like CreditKarma.com and CreditSesame.com may look like credit scores, but virtually no lender uses them in their decision-making processes.

Even if it is a free FICO score (FICO is the company that pioneered credit scoring and holds a monopoly on 90% of all credit-based decisions in the US), it is likely a version of FICO that is no longer used or never has been widely accepted by lenders.

However, the FACT Act allows consumers to view their credit reports in order to ensure their information is accurate. This minimizes the possibility of having a credit application denied due to incorrect information. It can also minimize the impact of potential identity theft.

If you pull your credit report online, you will have access to it immediately. If you order it by phone, it takes about two to three weeks to arrive.

Review the information on each credit report, and if you see an error, return to the CRA’s home page within 30 days of your order. Once there, click on the error dispute link. The CRA will ask for your credit report or file number, after which you can click on the credit information you are disputing and provide some nominal information explaining the reason for your dispute. You may also upload supporting documentation (bills, paid-in-full notices, etc.).

The dispute process is simple but not guaranteed to end in your favor. Creditors have 30 days to respond to your dispute. If they believe they have proof the information is accurate, they will deny your dispute, at which time you will need to contact them directly and ask to see such proof. If they agree that the reported information is erroneous, the CRA will remove or update the information per your request. If in the occasional cases, the creditor does not respond at all during the 30-day period, the CRA will automatically remove or update the disputed information in your favor.

2. Become an Authorized User

If you know that a close family member has good credit, you might consider asking if he or she would be willing to add you to their credit card account(s) as an authorized user. If so, the activity associated with that account will show up on your credit report. It will not have the same level of effect as having your own credit card, but it will have a positive influence on your rating.

Frequently, the family member might worry about the impact of your credit rating on his or her rating. You can assure them that as an authorized user, your credit will not affect them. They may be thinking of co-signed loans or co-owned accounts that actually do mutually influence each other’s ratings.

Additionally, your family member may worry that you will use the card inappropriately, and he or she will be stuck with the bill. While it is true that the account holder (your family member in this case) is responsible for all activity on the account, the reality is that you do not even have to use the card or even ever see it to benefit from its activity.

You may actually prefer asking your family member to have the card sent to his or her home directly. Once your family member receives the card, he or she can activate it and even shred it. That should allay fears of inappropriate usage.

If the activity on the card starts to turn negative (e.g. your family member misses a payment or maxes out a card), the information is not supposed to show up on your credit report. However, if it does, you can simply dispute it to have the account removed completely from your report.

3. Utilities and Cell Phone Accounts

Historically, utility and cell phone companies have not reported monthly payments to consumer reporting agencies.

If they did, they would have to follow all of the wide-ranging requirements of the Fair Credit Reporting Act of 1970, which they generally and understandably prefer not to do. Plus, some states may actually prohibit such credit activity reporting. Still, some utilities, such as a few in Minnesota, Detroit, and northern Illinois, do already fully report account activities to the CRAs.

Of course, if you close your utilities or cell phone account and do not pay what you owe, the utility or phone company will likely sell the debt to a collection agency. In turn, the collection agency will add your delinquent account to your credit report as a negative mark.

Still, if you have made on-time payments for several years, it does not hurt to ask to have that history reported. Many states have laws that prohibit public utilities from reporting account activity to the CRAs. A national movement that includes many federal lawmakers may change such prohibitions in the future.

In the meantime, contact your utility and cell phone companies to ask if they are able and willing to report your payment histories. This does not include any pre-paid cell phone accounts.

Another similar approach involves using Experian’s free BOOST service. After you sign up, you grant BOOST read-only access to your checking account and then identify the utility and phone bills you pay. Experian then reports these payments as if they were monthly payments to a creditor. Unfortunately, at the moment, neither Equifax nor TransUnion offers a similar service.

Similar to authorized user accounts, utility accounts do not influence your rating at the same level as a standard credit card account would.

4. Store Credit Lines and Card Accounts

Many consumers who have applied for a major credit card receive a response that the financial institution has denied their application. Such responses often include an explanation like this: “You do not have sufficient credit history to qualify for a credit card account.”

This brings up the “which came first” problem, the chicken or the egg. “How am I supposed to build my credit history if I can’t qualify for a credit card?”

Instead of applying for a major credit card from a national bank or even a regional credit union or bank, start smaller and start local

Tire and Brake Shops

If you need new tires or brake work done on your car or truck, your local or regional tire and brake store will often offer a small line of credit to customers with poor credit ratings. Your annual interest rate will likely range from 20% to above 30%, but if you pay off the full balance before the first payment due date, you will not likely have to pay any interest at all.

-

Apply for a line of credit at a tire shop, clothing, or department store

-

Pay the full balance of the newly opened card long before payments are due

-

Don’t apply for more than 2-3 accounts in one year

Be careful not to open an account if you do not have the cash to pay for it. Otherwise, you will likely end up on the painful end of high-interest charges.

Retail and Gas Cards

Besides a tire shop, you might consider a clothing store or department store that has its own credit card (e.g. Kohl’s, JC Penney’s, or Target). If you do end up qualifying, consider stopping at the customer service desk before leaving the store. There, you can pay off the purchase with cash or your debit card. Otherwise, you run the risk of forgetting the purchase and then only affording the minimum payment once the bill arrives a month later. This, of course, is exactly what the store hopes you will do.

Each time you apply for a tire shop line of credit or a store card, an inquiry shows up on your credit report (and dings your score up to 1%). Consequently, most experts recommend that you not apply for more than two or three such accounts per year.

Buy Not Pay Later Apps

Beginning in 2022, the three consumer reporting agencies (CRAs or “credit bureaus”) decided to begin collecting payment and balance information from buy-now-pay-later apps such as Klarna, Affirm, and Afterpay. However, it remains up to these data providers whether they will report your information to the CRAs.

Once that happens, though, it will mean that if you download and start using one of these apps, your on-time payments can help you to build a history of positive credit behavior.

However, as early as the summer of 2021, less than a year after these apps became popular, one in three users was already behind on at least one of their monthly payments (See Reuters). In most cases, this led to lower credit scores.

History proves that the more convenient purchasing becomes, the more likely consumers are to overspend to the point of being unable to meet their financial obligations. If you decide to pursue credit building using such an app, be sure to do so by purchasing only items you can afford to repay at any time.

5. A Secured Credit Card

If you struggle to qualify for a tire shop, retail store, and credit card, look next at applying for a secured credit card. Not all banks and credit unions offer them. Those that do will vary in the fees and interest they charge. Shop around for the best deal.

A secured credit card account requires that you deposit an amount into a bank or credit union savings account equal to the credit limit of the card. You will not have any access to the savings account until you either close the secured credit card account or convert it to a standard credit card.

Right up front, get it in writing that the bank or credit union will report your monthly payments to the CRA. Otherwise, the secured card will do nothing to help you qualify for additional credit in the future.

You can make purchases on the secured card just as you would with any credit card. Consider using it for just one small bill a month, such as your Netflix or your cell phone payment. Do not carry the card in your wallet.

Do not carry a balance on the card from month to month, and make your payments on time every time. Otherwise, the bank or credit union will shut down your card, take fees and interest charges out of your savings account, and require you to replenish the savings account fund before they open the card again. Moreover, you do not want a late payment showing up on your credit report while you are trying to build your credit rating.

After a year or so, ask the financial institution if they would be willing to convert your secured credit card to a standard credit card with no annual fee.

6. Credit-Builder Loans

The final option for building or rebuilding your credit involves these unique loans offered by a few financial institutions. Your bank or credit union will not generally advertise this product and may not even list it among their services, since they do not generate any income for the business. In fact, many tellers and member service representatives do not even know about these products, so if you are inquiring at your local bank or credit union if they have one, be sure to ask a manager.

Credit-builder loans look a lot like a forced savings account that charges you a fee. After qualifying, the financial institution places your loaned money into a secured savings account in your name, much like the account described above for a secured credit card. You cannot access the money in this savings account until after you have paid the loan in full. You actually make monthly payments on the loan for up to a year in order to pay it off (they do not typically include any pre-payment penalties if you choose to pay it off early). Only then do you’ll receive the money from the loan. Since you will likely pay 5% to 15% in annual interest on the loan and only earn up to 1% on the savings, this option can get expensive. However, most credit-builder loans max out at $500 to $1,000, so the amount of interest you pay over the year will like range from $50 to about $150.

While you can follow these steps in order, you may also choose to mix and match. If it makes sense in your situation, there is nothing wrong with getting a credit-builder loan and then, five months later, applying for a tire shop line of credit. Alternatively, you may open a retail card and also ask your electric company to report your payments to the CRA. The possibilities are endless.

Commit to Build Your Credit Rating

This brings up one last component of this process. If you are financially, emotionally, and otherwise ready to improve your credit rating, consider taking this credit-building commitment and survey. Committing to yourself and to others increases the likelihood of your success. Additionally, you will receive quarterly practical credit-building tips via email (you can opt-out at any time). The idea here is that the more tools and support you have, the more likely you are to succeed. Find more information and support at the Money Fit Academy on credit building, household budgeting, debt elimination, spending controls, and more.

Do’s and Don’ts of Repaying Debt

-

Don’t carry a balance just to build credit. Our score can be positively affected even if we pay off our balance every month in full.

-

Don’t close old credit accounts that are in good standing (unless they’re charging fees).

-

Don’t fall for the minimum payment trap. Making only minimum payments on credit card accounts leads to 15 to 25 years of debt.

-

Do make at least the minimum payment due on any debt payments.

-

Do whatever is possible to keep accounts from going to collections. NOTE: Work out payment arrangements with your original creditor AS SOON AS a collections notice is received.

-

Do pay down debt balances.

12 Months to a Better Credit Rating

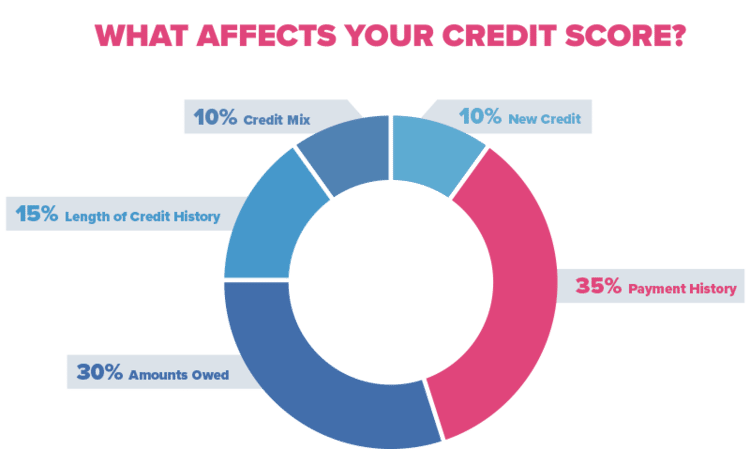

Here are several steps you can follow over the next twelve months to build (or rebuild) your credit history, remembering that no amount of “tricks” and no credit report company can rebuild credit if you’re in the habit of missing payments and maxing out cards. On-time payments and paying down your debts can account for 65% of your credit score.

-

Month 1: Sign up for Experian’s free BOOST credit-building product that tracks your utilities and phone payments as if they were payments on a loan or credit line. This only works on your Experian credit report, though. For Equifax and TransUnion, consider asking your utilities and cell phone companies to report your history of on-time payments to the credit bureaus. Note: They do not do so automatically. If they are able to accommodate your request, be sure to allow about a month for this information to show on your credit report. Some states do not permit such reporting.

-

Month 2: Consider asking a family member (parent) with good credit to request an authorized user card in your name from their credit card company. Note: This option is particularly meant to help the teens and young adults in our life become established, but it can be helpful for adults as well. Expect at least one month for such an account to begin impacting your credit.

-

Months 2-7: Apply for no more than one or two new accounts a year, starting with a tire store line of credit, followed by a retail store account and/or a gas station card. You might also look into a credit builder loan at a bank or credit union. Essentially, these are forced saving accounts that report your monthly “deposits” as credit payments. However, unlike saving accounts, you pay interest instead of earning it.

If these steps are not successful, consider asking a bank or credit union for a low credit limit secured credit card. You will typically need between $300 and $800 to open such an account. -

Months 8-12: After making at least six months of on-time payments to at least two new accounts listed above, you may be ready to apply for a Visa or MasterCard credit card from a major national bank.