The Most Common and Confusing Credit Question

As a financial educator with over 1,000 workshops facilitated in person, I’ve heard learners ask certain questions over and over, indicating that these concerns are common to most American consumers. Above all other personal finance topics, credit scores and credit reports generate more uncertainty and confusion than all other subjects combined, including budgeting, debt, and saving. The most common question compares the problems associated with bad credit versus those associated with having no credit.

Is it worse to have no credit or bad credit?

You can build credit from scratch faster than you can rebuild bad credit since negative activity remains on your history for seven years or more. Additionally, most lenders who claim to offer loans and credit lines to consumers with poor credit will also loan to those with no credit.

As with everything in life, you will find exceptions to this rule. However, I have found that most people asking this question already have bad credit, or they have had poor credit in the past and worry about a family member or friend going through similar experiences.

It makes sense, right? If you already have good credit, you already know its benefits. If you have no credit, you don’t plan to have bad credit any time soon.

No Credit Is Better than Really Bad Credit

While the rest of this post addresses issues related to having poor or bad credit, let’s state this right now that in 99.99%* of the cases where you can qualify for a service or product with poor or bad credit, you can also qualify for that same service or product with no credit. *That figure, by the way, is based on absolutely no scientific proof but is an educated guess (which science calls a hypothesis).

Just How Bad Are We Talking?

Now, let’s assume that the vast majority of readers currently have or have had in the past a poor credit rating. You also likely wonder if your poor credit rating has doomed you to a lifetime of financial despair or if you somehow missed the simple secret to using a credit card without ruining your credit rating.

Let’s address these concerns and more below.

To understand the rest of this post, here is the most critical concept to grasp that most American consumers fail to understand:

Your credit score attempts to predict the potential level of risk you pose to prospective lenders.

Your score says nothing about you being a good person or a bad person. It actually doesn’t reveal much about your character, despite the fact that lenders include “character” in their 4 (or 5) Cs of credit.

Credit does not even indicate how responsible you are. After all, does someone hit with $200,000 of medical bills in collections that they can’t afford to pay someone to equate to being irresponsible? Of course not.

Not all bad credit scores are created equal. In fact, the three major consumer reporting agencies (aka “credit bureaus”) generate their own version of your credit score, each of them differing from the others.

Additionally, the major credit scoring company (FICO) has more than a dozen credit scoring models that lenders can pick and choose from based on their industry and target borrowers. Suffice to say, that depending upon the score model and the company generating it, a credit score can carry limitless implications for you as a consumer.

FICO produces the credit score used by most lenders. Since long before the introduction of the still-popular FICO 8 model in 2009, FICO scores have started at 300 on the low end (highest risk borrowers) and top out at 850 (lowest risk borrowers).

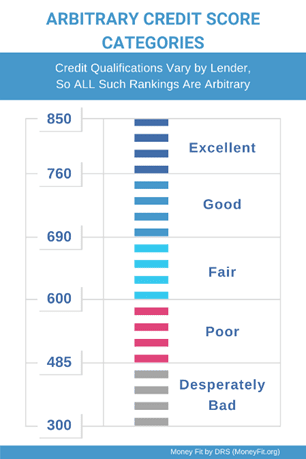

If you search the Internet to figure out which credit scores are considered excellent, good, fair, and poor, you will find various companies, including some of the credit bureaus, offering scales and graphics to help you out. Unfortunately, they all attempt to define the undefinable.

Here’s a typical, but fairly arbitrary, projection of good score and bad score ranges, yet it carries as much validity as those you’ll find anywhere else:

Here’s a typical projection of good scores and bad scores, yet it carries as much validity as those you’ll find anywhere else:

-

760-850 Excellent

-

690-759 Good

-

600-689 Fair

-

485-599 Poor

-

300-484 Desperately Bad

Basic Meanings of Score Classifications

As a general rule, excellent credit will qualify you for the best repayment terms the lender can offer. However, the score that qualifies as excellent will vary from lender to lender just as their approval policies vary.

Good credit will qualify you for very reasonable repayment terms with most lenders. Although unlikely, a few highly conservative companies may choose not to offer you a loan at all. Most, though will simply offer you a loan with a less appealing interest rate than the one advertised. Their common advertising disclosure, “Terms and conditions may vary,” will apply directly to you.

Fair credit means you can still qualify for a loan from many lenders, but your interest rates will likely amount to double those offered to borrowers with excellent credit. Over time, any loan you qualify for will cost you two to three times those offered to borrowers with a higher credit rating.

Poor credit will prohibit you from qualifying for a loan with the vast majority of lenders. You will likely need to work with companies that specifically focus on high-risk borrowers. This means you will likely have to pay exorbitant interest rates in addition to annual (or even monthly) fees and possibly a large down payment. Not surprisingly, such high costs will keep most consumers with poor credit from even applying for loans.

Desperately bad credit means that if you can even find a lender to offer you a loan, you will likely pay more in fees per month for the same loan amount than someone with excellent credit will pay in a year (or in ten years).

No credit score, including an 850, can be definitively considered perfect credit. Even those few consumers currently hanging onto an 850 credit score still pose a risk to prospective lenders. Plus, each lender chooses what defines excellent credit based on how much risk they want to take on as a business.

You might think that a single point difference won’t matter much. After all, does a 690 score mean much more than a 689? Actually, it can and often does. At least to individual lenders.

Each lender sets their own score ranges that qualify for their best repayment terms and interest rates and those that qualify for their other products (e.g. higher interest rates and down payments).

So, if your lender of choice gives their best interest rates to applicants with a 690 or better credit score, and your score is 689, you will end up paying much more over time in interest and fees. However, you also have the option of applying for a loan from another lender who might give you better interest rates than the first lender, even if you have a 689 score.

What You Can Still Do with Bad Credit

As noted above, even with a poor credit rating, you can still find lenders who will qualify you to borrow money. However, because many want to avoid the expected humiliation that accompanies a declined application, consumers with poor credit tend to go directly to high-risk lenders (often referred to understandably as predatory lenders) for their borrowing activities. These lenders include payday lenders, car title loan companies, pawnbrokers, and the related service of rent-to-own businesses.

Since credit gets used for reasons far beyond loans, you may wonder if you can still qualify for other services. For example, can you still get a utility account if you have a poor credit rating? The answer is yes. In fact, utility companies are legally prohibited from denying service to households with poor credit. However, if you owe money to the utility company from a previous account, you will likely need to pay that balance off first before getting approved. Also, your poor credit will likely mean you will need to come up with a security deposit, sometimes equivalent to two or three months’ worth of services.

Poor credit will also make insuring your vehicle, your home or apartment, and even your life much more expensive. Because most insurance companies use an insurance score (very similar to traditional credit scores) when setting monthly premiums, they often have a baseline credit score below which they may deny you coverage completely. In such cases, you can still find coverage, but you will likely need to work with an insurance company specializing (i.e. charging extremely high monthly premiums) in high-risk drivers.

Many consumers with poor credit worry they may not get a job because of their poor credit rating. Some employers include credit histories in their background checks, especially if they come from the law enforcement, government, or financial industries. However, the law prohibits employers from accessing credit scores during and after the hiring process. Some states even prohibit the use of all credit report information by employers. Still, if you have a poor credit score, your credit history will reflect the same negative information. Many employment experts recommend being upfront with potential employers during the hiring process, giving you a chance to explain how you are trying to improve your credit situation and how it should not interfere with your work performance.

What You Cannot Do with Bad Credit

No matter the reason for your poor credit, you may not be able to talk certain property managers into approving your lease and renting to you. Even though your rental history does not appear on your credit report, your history of payments on other financial obligations can provide a relatively reliable projection of how likely you are to pay your rent on time in the future.

Even before you apply, we recommend you contact different apartments of interest to you and ask what their credit score qualifications are. Many will tell you right up front that unless you have a 650 or 670 or higher credit score (for example), you will not qualify for a lease with them. If you find yourself in such situations, avoid losing your application fee and look elsewhere.

Although most cell phone companies have moved to the pre-paid service model, some providers still offer service plans based on annual contracts. In such cases, you will likely need good or excellent credit to qualify. Otherwise, you will find your application re-directed to the company’s prepaid version, meaning you will likely pay more per month and get fewer perks.

If you think college is in your future and you worry about qualifying for a student loan, take comfort in the fact that federal student loans do not take your credit into account. They are needs-based products. Whether you have excellent credit or no credit, you will qualify for the same amount at the same repayment terms based on your financial need.

Fixing Bad Credit

If you find yourself dealing with the downsides of poor or desperately bad credit, start with the hope that you can change things, because you can.

Bad credit is not forever.

While negative credit activity remains on your credit report for seven years from the time it occurred (except a Chapter 7 bankruptcy, which stays for 10 years), the further in the past that activity becomes, the less it hurts. After seven years, it comes off your credit report automatically and ceases to affect your score. Yay! Happy days!

Get Current

The first thing to do, and the action that will have the greatest positive effect on your credit rating, involves getting current on all of your credit account monthly payments. From credit and store cards to car loans and mortgages, the more accounts reporting as “paid as agreed,” the better your score will become.

If you have too many accounts to get current on all at once, start with your accounts tied to property (e.g. a mortgage and a vehicle). This ensures you won’t lose something you have been paying on for months or even years.

Then, work on any account at risk of going to collections and court. Once it goes to court and the creditor secures a judgment against you, you might find it difficult to arrange anything but the payments the creditor requests. Sometimes, bankruptcy can be the only option in such cases.

Next, get current on the newest account first. Activity (payments and status changes) on newer accounts have a greater influence on your credit rating than activity from older accounts.

Pay Down Balance

Instead of trying to accelerate the repayment on all your accounts at once, start with the newest account first. Make the minimum payments on all other accounts while you send every extra penny to the account you opened most recently. Like getting your newest account current, paying down the balance on your newest account improves your credit rating faster than paying down the balance on older accounts (assuming all other account information is similar).

Keep Old Accounts Open

Although tempting, and despite what well-meaning but poorly informed online talking heads might recommend, do not close old accounts. Closing an account will usually have an adverse effect on your credit rating rather than a positive one. By closing the account, you eliminate its credit limit from the credit score calculations. This increases your “utilization” rate, meaning that your total balances are now closer to your total credit limits, and that will hurt your score.

Consider a Debt Management Plan

If your credit card accounts have interest rates in the upper teens or higher, or if you have multiple collection accounts or medical bills, you should reach out to a nonprofit consumer credit counseling agency like Money Fit to discuss a debt management plan (DMP). With a DMP, you make a single monthly payment through the agency, which in turn disperses your

payment to your creditors. Even more helpful, the agency works with your creditors to arrange for lower interest rates and more affordable monthly payments.

How Long It Takes to Build and Rebuild Credit

One of the big misconceptions surrounding the question of bad credit versus no credit involves the time it takes to repair the former and overcome the latter. Taking a look at the basics of both, we’ll see again that starting from scratch can take less time than recovering from poor credit, though neither is permanent.

Bad Credit

Although negative credit activity stays on your credit for seven years, it hurts less and less as time goes by. However, at no point does it turn from a negative influence on your credit score to a positive one. Negative activity will only create downward pressure on your credit score.

Thus, it can take up to seven years of positive activity to counter your bad credit completely.

Still, I have met consumers who have filed for bankruptcy and within two years had rebuilt their credit rating to the point of qualifying for a decent mortgage loan. It takes work, but it can happen.

No Credit

Although you will not likely qualify for any major credit card if you have no credit, you can take steps to get there within a year or less by starting small. If you already have utility and cell phone payments in your name, you can use Experian’s free BOOST product to instantly generate a credit score (though only through Experian and not Equifax or TransUnion).

Without a credit history, you can also usually qualify for an account through your local tire and brake store and even some clothing stores and gas stations. Use just two of these accounts only minimally and pay them off monthly to build your credit wisely. After six to twelve months of such activity, you may be able to qualify for a credit card from your current bank or credit union. Keep the credit limit small (e.g. $500 to $1,000). Then, like the other accounts, use the card just once a month and pay it off in full every month. See our article on 6 Steps to (Re)Build Your Credit for more details.

Related Questions

Is poor credit the same as bad credit?

Poor credit and bad credit are interchangeable terms. However, what is considered bad credit can vary by lender, depending upon their loan eligibility policies. Some lenders might consider a 670 credit score as bad while others may not think you have bad credit until your score is below 515.

What is your credit score if you have no credit?

Your credit score is based on your credit history. If you have no credit history, you have no credit score. Major credit scoring models will simply indicate that someone without a credit history is “not scoreable” or has an “insufficient credit history” to generate a credit score.