Get the Facts Before You Decide on a Reverse Mortgage

If you’re 62 or older and looking for ways to supplement your retirement income, you may have heard about reverse mortgages. But let’s be honest, reverse mortgages often get a bad rap. Maybe you’ve heard people call them scams, or maybe you’ve seen headlines warning about the risks. It’s easy to feel confused or even skeptical.

Here’s the truth: reverse mortgages are not scams. They’re legitimate financial tools designed to help older homeowners like you access the equity in your home. But they’re not for everyone, and they do come with rules, responsibilities, and costs that you need to understand before making a decision. That’s where we come in.

As a HUD-approved housing counseling agency, we’re here to help you separate fact from fiction. In this article, we’ll break down what reverse mortgages are, how they work, and whether they might be a good fit for your financial goals. By the end, you’ll have the knowledge you need to make an informed choice—and hopefully, you’ll feel confident enough to schedule a Reverse Mortgage Counseling session with us to explore your options further.

What Is a Reverse Mortgage?

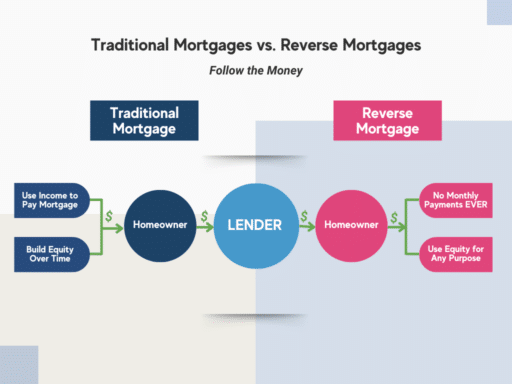

A reverse mortgage is a type of loan that allows homeowners aged 62 or older to convert part of their home equity into cash. Unlike a traditional mortgage where you make monthly payments to the lender, with a reverse mortgage, the lender pays you. You can receive the money as a lump sum, monthly payments, a line of credit, or a combination of these options.

The most common type of reverse mortgage is the Home Equity Conversion Mortgage (HECM), which is insured by the Federal Housing Administration (FHA). Because HECMs are federally regulated, they come with important protections for borrowers.

For the purposes of this post, we are discussing federally insured HECM reverse mortgages. Any reverse mortgage that is not federally insured may have more flexibility but provides fewer borrower protections. Only consider them after minute scrutiny.

How Do Reverse Mortgages Work?

When you take out a reverse mortgage, you’re borrowing against the equity in your home. The loan doesn’t have to be repaid until you sell the home, move out permanently, or pass away. At that point, the loan balance (including interest and fees) is typically paid off by selling the home.

One important thing to know is that reverse mortgages are “non-recourse” loans. This means that neither you nor your heirs will ever owe more than your home’s value at the time of sale, even if the loan balance exceeds that value.

However, as a borrower, you still have responsibilities. You must continue paying property taxes, homeowners insurance, and maintenance costs for your home. Failure to meet these obligations could put your loan in default.

What Is the Downside of Getting a Reverse Mortgage?

Reverse mortgages aren’t perfect. They have their downsides just like any other financial product. Here are some common concerns:

Reverse Mortgage Pitfalls

- Reverse mortgages come with high upfront fees, including origination fees and mortgage insurance premiums.

- Interest accrues over time, increasing the loan balance.

Reverse Mortgage Problems

- If you fail to pay property taxes, homeowners insurance, or maintain the home, you could face foreclosure.

Reverse Mortgage Cons

- They are not ideal for short-term financial needs or borrowers with other available assets.

Reverse Mortgage Complaints

- Some borrowers have reported feeling misled about loan terms by unethical lenders. Always work with HUD-approved lenders and attend required counseling.

Is a Reverse Mortgage a Good Idea?

The answer depends on your unique financial situation and goals. For many retirees, reverse mortgages can be life-changing, but they’re not one-size-fits-all.

Reverse Mortgage Pros

- Supplement Your Income: Reverse mortgages provide tax-free income to help cover living expenses.

- Stay in Your Home: You can access your home’s equity without selling or moving.

- Borrower Protections: FHA-insured HECMs come with non-recourse protections and mandatory counseling.

Reverse Mortgage Protections

HECM loans are highly regulated by HUD and FHA to protect borrowers from predatory practices:

- Lenders must disclose all costs upfront.

- Borrowers must complete HUD-approved counseling.

- Non-recourse clauses ensure borrowers and heirs won’t owe more than the home’s market value.

Why Do Banks Not Recommend Reverse Mortgages?

Some banks and financial advisors hesitate to recommend reverse mortgages due to:

- Higher upfront costs compared to traditional home loans.

- Reduced home equity for heirs.

However, reverse mortgages remain a viable option for retirees needing financial flexibility.

Best Uses for a Reverse Mortgage

- Paying off an existing mortgage or other debts.

- Funding medical expenses or long-term care.

- Making home improvements to age in place.

How Much Money Do You Get from a Reverse Mortgage?

The amount varies based on:

- Age: Older borrowers qualify for more.

- Home Value: Higher appraisals allow for greater loan amounts.

- Interest Rates: Lower rates increase loan proceeds.

What to Expect During a HECM Counseling Session

All borrowers must complete a counseling session with a HUD-approved agency. This session covers:

- Your financial goals and situation.

- Reverse mortgage benefits, risks, and alternatives.

- Repayment terms and borrower responsibilities.

How Does a Reverse Mortgage Work When You Die?

Upon the borrower’s death, heirs can:

- Pay off the loan balance and keep the home.

- Sell the home and use the proceeds to repay the loan.

- Walk away if the loan balance exceeds the home’s value.

Get the Facts About Reverse Mortgages

Reverse mortgages are not scams. They are legitimate financial tools for older homeowners needing flexible financial solutions. Before making a decision, schedule a Reverse Mortgage Counseling session with a HUD-approved agency to explore your options.