Bankruptcy and You: How the Laws Affect Consumers

Navigating the complexities of bankruptcy can be overwhelming. With laws like the Bankruptcy Abuse Prevention and Consumer Protection Act (BAPCA) in place, it significantly affects consumer filings, especially as it relates to Chapter 7 filings. BAPCA also requires individuals filing for bankruptcy to utilize credit counseling organizations such as Money Fit by DRS Inc. for two separate filing certificates, one for credit counseling and the other for debtor education. Recent and upcoming bankruptcy legislation has been to take aim at student loan debt and that the private loan market isn’t providing similar consumer protections as the federal loans do. One thing is certain, bankruptcy law and code will continue to change and adapt to current financial and economic conditions. Be sure to research the current bankruptcy code when deciding whether to pursue filing for bankruptcy protection.

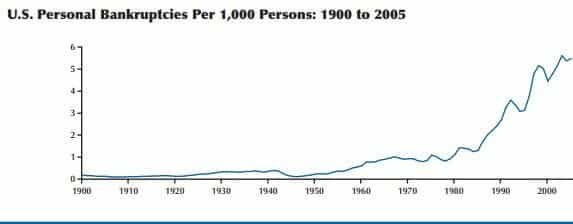

Bankruptcy Filing Statistics in America Since 1900

When looking at personal bankruptcy filings in America over a period of over 100 years, it makes sense to look at per capita filings. Reviewing how many individuals filed for bankruptcy per 1,000 gives us a good sense of how the usage of bankruptcy protection has changed over the years.

As highlighted above, we can see that as the Bankruptcy Code has been amended over the years, especially as it relates to the last 30 years, consumer filings have increased dramatically due to increased access and efficiencies as it relates to the filing process.

(Source: St. Louis Federal Reserve | The Rise in Personal Bankruptcies: The Eighth Federal Reserve District and Beyond)

Bankruptcy and the COVID-19 Pandemic

Bankruptcy filings appear to have peaked in 2005, however, with the onset of COVID-19, it may be safe to assume that bankruptcy filings may be on the rise over the next several years.

The United States Department of Justice provides a means test (to determine if the debt can be liquidated through Chapter 7) with the Bankruptcy Form 122. This form reviews your income and expenses as well as items like the size of your family and how much disposable income you may have available to be applied to your debt. The form was created to restrict individuals from unnecessarily filing for bankruptcy protection, however, the test itself has appeared to be less restrictive than initially feared.

As with all large-scale national financial setbacks, the full impact of COVID-19 will be fully realized within a few years of the overall financial recovery of the United States. One caveat of consideration would be how large and lasting the impact will have been due to the global ramifications of the virus. Most bankruptcy filings will have been processed through the courts and the overall scale of the financial impact of the pandemic should be better understood.

Next Installment in the Bankruptcy in America Series

We’ll take a look at who files for bankruptcy and why. The purpose is to look at the reasons why individuals seek bankruptcy protection, as well as to look at some famous bankruptcy filers over the years and to highlight the fact that you’re certainly not alone. Some names on the list may surprise you, and some are well-known for filing for personal bankruptcy protection.

One person who won’t be on the list might surprise you. Considered a serial bankruptcy filer by some, President Donald J. Trump has never filed for personal bankruptcy protection. Rather, businesses he has operated such as casinos and hotels have filed for bankruptcy six times between 1991 and 2009. We’ll focus on personal bankruptcy filings since that is the core of what we’re reviewing in our quest to help you determine if filing bankruptcy is in your best interest, how to file, and what your next steps may be.

Related Content:

What to do if you can’t afford to file for bankruptcy